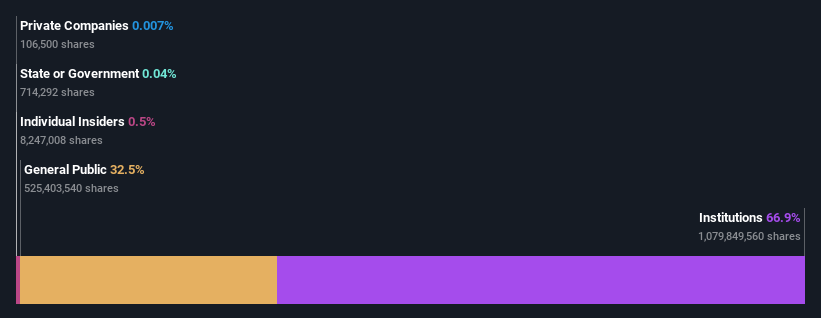

With 67% ownership of the shares, Advanced Micro Devices, Inc. (NASDAQ:AMD) is heavily dominated by institutional owners

To get a sense of who is truly in control of Advanced Micro Devices, Inc. (NASDAQ:AMD), it is important to understand the ownership structure of the business. We can see that institutions own the lion's share in the company with 67% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

Because institutional owners have a huge pool of resources and liquidity, their investing decisions tend to carry a great deal of weight, especially with individual investors. Hence, having a considerable amount of institutional money invested in a company is often regarded as a desirable trait.

Let's delve deeper into each type of owner of Advanced Micro Devices, beginning with the chart below.

See our latest analysis for Advanced Micro Devices

What Does The Institutional Ownership Tell Us About Advanced Micro Devices?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

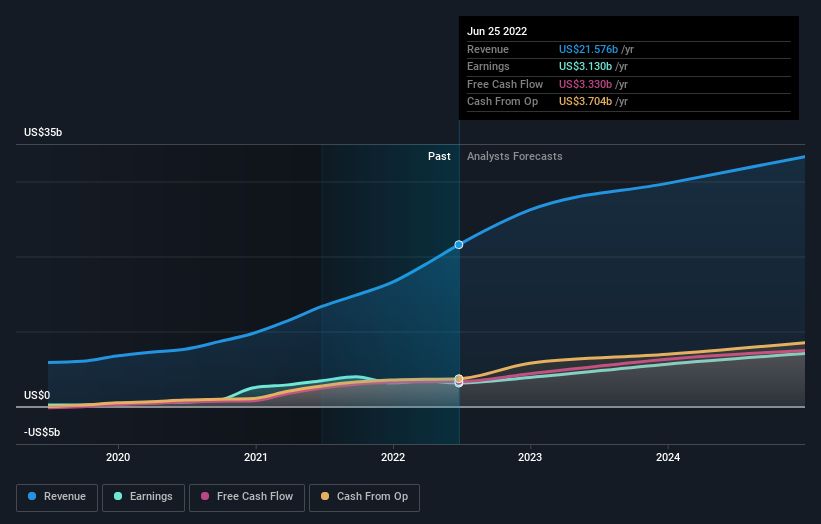

We can see that Advanced Micro Devices does have institutional investors; and they hold a good portion of the company's stock. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Advanced Micro Devices' earnings history below. Of course, the future is what really matters.

Institutional investors own over 50% of the company, so together than can probably strongly influence board decisions. Advanced Micro Devices is not owned by hedge funds. The Vanguard Group, Inc. is currently the largest shareholder, with 8.3% of shares outstanding. With 7.2% and 4.0% of the shares outstanding respectively, BlackRock, Inc. and State Street Global Advisors, Inc. are the second and third largest shareholders.

A deeper look at our ownership data shows that the top 25 shareholders collectively hold less than half of the register, suggesting a large group of small holders where no single shareholder has a majority.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Yahoo Autos

Yahoo Autos