Is Burford Capital's (LON:BUR) Share Price Gain Of 171% Well Earned?

While Burford Capital Limited (LON:BUR) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 18% in the last quarter. But in stark contrast, the returns over the last half decade have impressed. It's fair to say most would be happy with 171% the gain in that time. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. The more important question is whether the stock is too cheap or too expensive today. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 40% decline over the last three years: that's a long time to wait for profits.

Check out our latest analysis for Burford Capital

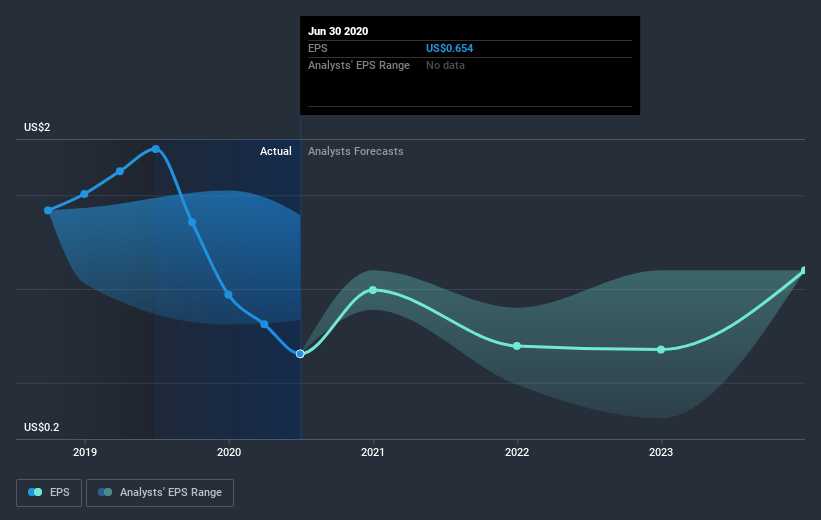

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over half a decade, Burford Capital managed to grow its earnings per share at 19% a year. This EPS growth is reasonably close to the 22% average annual increase in the share price. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Burford Capital's earnings, revenue and cash flow.

Yahoo Autos

Yahoo Autos