Will China’s Lock on Graphite Supplies Become a Problem for EV Manufacturing?

Graphite is one of the essential minerals needed to produce lithium-ion batteries, but the US is largely lacking in domestic production of the key material.

As a result, most graphite used in domestic EV production is imported from China, Chile, and Australia, though China holds a near monopoly on the processing of graphite.

Geopolitical trade wars are always brewing, as China announced graphite export permits last week. But how does this material supply change affect EV consumers?

It shouldn't come as a surprise that most materials needed to manufacture modern electric vehicles aren't indigenous to the United States. Sure, a bit of graphite exists in North America, and lithium is plentiful but protected throughout swaths of the country. However, neither amount is really available for Ford's future production plans.

As a result, mixed into the conversation surrounding lithium, graphite, cobalt, and manganese is a United Nations-like geopolitical string map connecting resources to producers. China is leading the way by a significant margin, as it claims over 80% of essential minerals and their respective processing standards, according to The New York Times.

Vocal outcry from global leaders and domestically centered statements from auto executives signal a desire to move toward production independence. Such a business move is unlikely in the very near future for many EV-hopeful nations, and China is well aware of this.

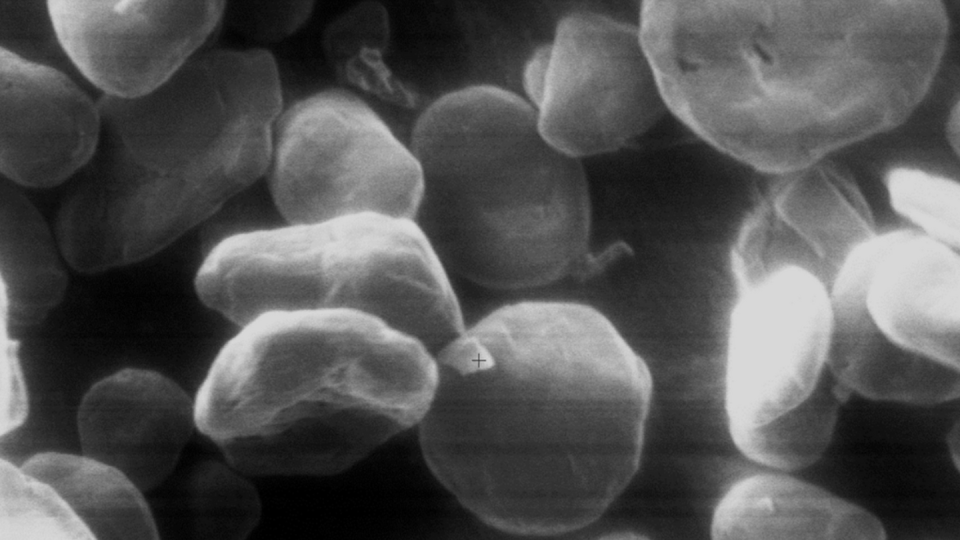

Just last week, Chinese officials announced they would now require export permits for some graphite products, in an effort to bolster national trade security. Exporters will now apply for permits to ship two graphite types—synthetic graphite material and natural flake graphite—both of which are used in EV batteries.

Not only is China leading the way in graphite mining, but it's adept at processing the mineral as well. Notably, the graphite pitch coating process adds 50% of the mineral's value as it relates to EV production, further emphasizing China's grasp of the material.

So, what does a new, costly permitting process mean for automakers and their consumers?Pricing will be going up, of course! As is typical of a major industry shift, analysts and automakers are eager to proclaim that prices will rise on every level, but there may be some validity to these claims in this case.

"With this new graphite export curb, South Korean firms which heavily rely on China for graphite imports would need to seek alternatives, such as mines from the United States or Australia, but it would likely increase the cost burden for many," said Kang Dong-jin, an analyst at Hyundai Motor Securities, in an interview with Reuters.

But that view isn't shared across the board, as energy analysts explained that such temporary controls could have little to no effect on EV production in the short term.

Additionally, analysts from Mysteel, a commodity pricing service, noted that graphite prices are down 25% from the beginning of the year, indicating decreasing demand.

Data from Project Blue, an energy industry monitoring agency, shows that demand for graphite and current production levels are about even, but this harmony isn't set to last long. Graphite demand is projected to overtake supply by 2025 and could continue that way through 2033, as many automakers edge closer to their all-electric dates of 2035.

Unfortunately for automakers, building an automotive-grade battery is nearly impossible without graphite, according to LMC Automotive.

Graphite makes up 95% of the anode in a traditional lithium-ion battery, meaning its absence would be a significant problem. For reference, around two pounds of graphite are needed per kilowatt of battery energy.

But there is one fledgling alternative to graphite that could ease this heavy reliance: silicon.

"It's been known for a long time that using silicon as an anode material can significantly improve energy density. Many more lithium atoms can be stored in silicon than in graphite. In fact, up to 10% silicon is blended with graphite anodes today for this very purpose," writes Al Bedwell, Director of Global Powertrain at LMC Automotive.

Stabilizing silicon, however, presents significant challenges, as it tends to expand and contract up to 300% during the charge and discharge cycle. As a result, most manufacturers have shied away from silicon, citing packaging constraints and reliability concerns.

But US-based Sila Nanotechnologies has seemingly cracked the code, with a silicon anode majority battery set for production in the incoming electric Mercedes-Benz G-Class. Plus, the application of silicon, as opposed to graphite, is largely regarded as battery weight-reducing, depending on the vehicle and battery size.

Looking forward, even the rise of silicon won't initially be enough to meet claimed future EV demand. While future demand is up for question at the moment, experts agree that sourcing graphite outside of China will be critical to the domestic EV market.

Companies like Graphex Technologies are beginning this process by finding new graphite streams, namely from free-trade countries like Canada and Australia. Furthermore, the US' only domestic graphite company, Northern Graphite, is calling for additional support from the public and private sectors.

"This news out of China underscores that the onus is on the West to develop secure sources of graphite supply to ensure a smooth energy transition," said Northern Graphite CEO Hugues Jacquemin. "I think it's time for government and markets to increase their support of the graphite industry if it's going to be ready to support the energy transition."

Also well positioned to address this market dynamic is battery producer Our Next Energy in Novi, Michigan. The company has developed an anode-free chemistry that requires no graphite at all.

Should the US expand its domestic mineral (lithium and graphite, specifically) production? Or should these resources be protected? Please share your thoughts below.

Yahoo Autos

Yahoo Autos