Pagos raises $34M as the demand for 'payment intelligence' rises

With global digital payments revenue expected to reach $14.79 trillion by 2027, payment infrastructure has arguably never been more critical. But at the same time the tech is becoming essential, the costs and complexities associated with it are increasing. One recent survey shows that merchants' satisfaction with their payment processors has declined massively, particularly when major technical hurdles arise.

Seeking to find solutions to these problems, Klas Bäck, Albert Drouart and Dan Blomberg founded Pagos, a "payment intelligence" infrastructure startup. Made up of payment experts with backgrounds from Braintree, PayPal and Stripe, Pagos turns disparate digital payments data into actionable insights without requiring customers to change their payment processors.

CEO Bäck and Drouart held senior leadership positions at Braintree/Venmo and PayPal over the last eight to nine years; Braintree/Venmo was acquired by PayPal in September 2013. Blomberg, for his part, has launched seven startups and sold five over the last two decades.

"Payment processing is fundamental to customer relationships, revenue and a business’s bottom line, but is getting more and more complex to manage well," Bäck told TechCrunch via email. "Most companies don’t have the tools, data, or knowledge to develop or execute on an effective payment strategy; even those that do often leave significant opportunities on the table. Pagos was founded on the principle that almost all companies need help to be more data driven around their payment execution."

Payments infrastructure vendors aren't exactly a dime a dozen, but there's a growing amount chasing after the massive market opportunity. Streamline, headquartered in San Francisco, recently raised $4 million for its business-to-business-focused payments product suite. Kushki is a much larger player -- the Ecuadorian payments infrastructure startup landed $100 million last year at a $1.5 billion valuation.

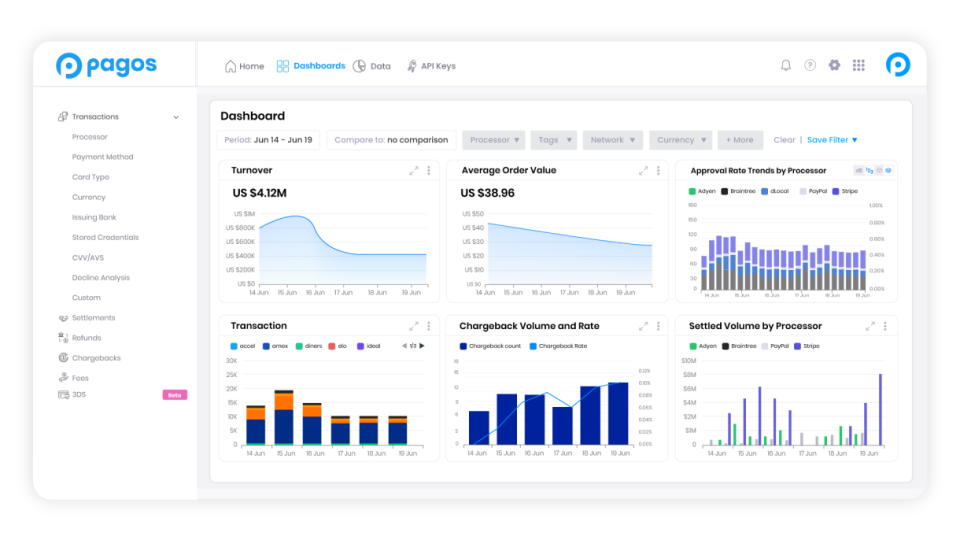

So what does Pagos bring to the table? Bäck claims that it uniquely allows companies to stream and store their payments data -- including commerce and fraud data -- in one place. From a single dashboard, customers can visualize the data and keep track of metrics, including transaction, payment authorization and risk performance.

Pagos' financial monitoring dashboard. Image Credits: Pagos

Pagos offers connections to payment processors such as Adyen, Chase, Braintree, PayPal, Stripe and WorldPay, as well as data ingestion APIs so that businesses can stream payments data and custom metadata into the platform.

Yahoo Autos

Yahoo Autos