Rolex Daytonas have outperformed the stock market over the past year as collectors pile in to the $20 billion secondary market for luxury watches

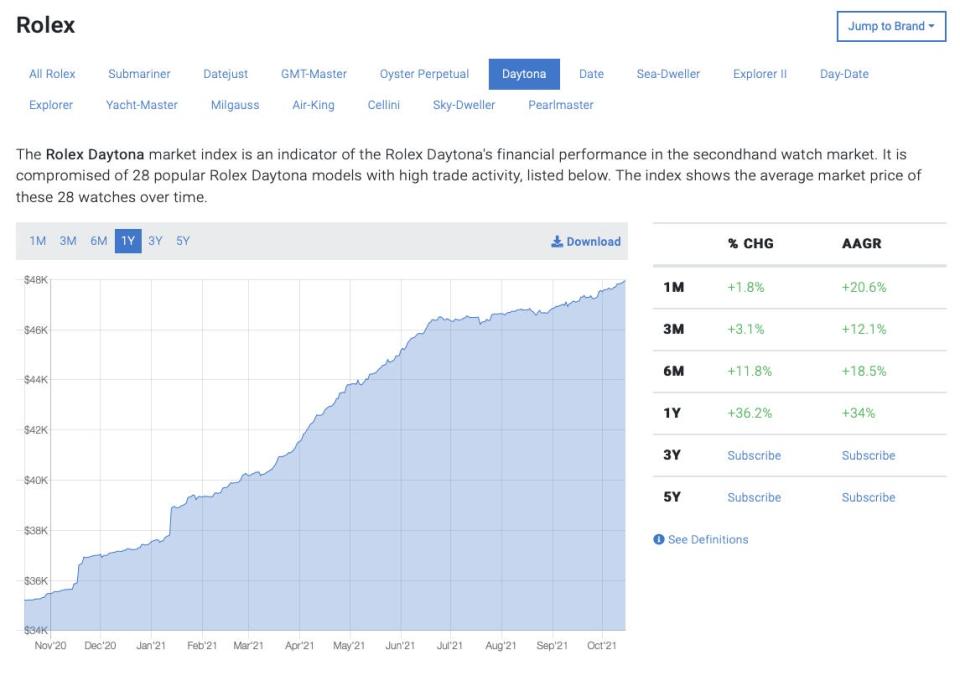

The average price of a Rolex Daytona has increased 34% over the past year to reach nearly $48,000.

Limited new supply is pushing the secondary market for luxury watches to new heights.

Even so, Bob's Watches CEO Paul Altieri says Rolex remains a "relatively affordable" luxury.

Imagine it's October 2020, and you've got a cool $35,000 kicking around that you want to invest.

The conservative choice would, of course, be to put it in a low-fee index fund or ETF that tracks the performance of the market, like the S&P 500. One year later, your reward for being such a disciplined investor in a booming market would be roughly $10,000 added to your net worth.

Your choice would be pragmatic, yes, but what's the fun in that?

Meanwhile, had you managed to get your hands on a highly coveted Rolex Daytona, that initial $35,000 would be worth nearly $48,000 - a $3,000 better return than investing in the market.

"Rolex is so hot right now," said Paul Altieri, the CEO of Bob's Watches, which is the largest seller of pre-owned Rolexes. "It's a hundred-year-old, iconic brand, but it's as hot today as it's ever been. And they cannot produce watches and products fast enough."

Rolex reportedly makes about 800,000 new watches each year, but that is far from enough to meet current demand. That scarcity has led to a secondary market that was already gaining steam before the pandemic kicked off a frenzy for all sorts of collectible luxury goods.

A report from McKinsey estimates the total value of the pre-owned luxury watch market to be currently worth $20 billion, and it's set to be the industry's fastest-growing retail segment, topping $29 billion by 2025.

Rolex has a quarter of the market share for new Swiss watches - nearly three times the share of the next largest brand, Omega - giving its watches a commanding presence in the resale market.

In the first decade of his business, Altieri said Rolex prices would reliably tick up every month or quarter or so. Now, he says they're going up on a weekly basis and his company is buying and selling up to 800 watches per month.

Bob's Watches buys every watch that it sells, so the recent rising prices are squeezing the the margins a bit, Altieri says, but the increase in volume is making up the difference.

And while lines like the Daytona or Yacht Master garner the most enthusiasm, Rolex's more modest mainstay models are humming along steadily too. On average, Rolexes have gained 21% in value in the past year - admittedly less than the S&P 500 this year, but not a bad return.

"We still believe that even at today's prices, they're still affordable luxury," Altieri said. "The average Rolex is $11,000, so it's much more affordable than a $30,00 or $40,000 Patek or a $70,000 Audemars Piguet."

Luxury watches in general - and Rolexes in particular - have been a popular store of wealth for decades, especially in times like these when inflation concerns are on the rise.

The supply of new watches coming from Rolex is limited - a scarcity the company said is "not a strategy on our part" - which means the prices for pre-owned watches are likely to continue their decades-long trend.

While certain Rolex models have outperformed assets like real estate, gold, or stocks, they have admittedly been left in the dust by the recent boom in cryptocurrencies. But here's the thing: You can't wear a bitcoin on your wrist.

Read the original article on Business Insider

Yahoo Autos

Yahoo Autos