Silicon Valley Bank trading halted; staff asked to work from home as SVB seeks a buyer, say reports

Update: Well, SVB stock never went live again, and four days on, the search for a buyer for SVB Bank continues. Now under the control of the FDIC, SVB Bank reportedly had a number of suitors over the weekend for a planned auction process including PNC Bank and the Royal Bank of Canada. But by Sunday, interest and urgency appeared to wane after the U.S. government said it would guarantee all deposits in the bank -- a significant move, since when the bank collapsed on Friday, the vast majority of those deposits were above the $250k threshold insured by the FDIC, and uninsured by SVB itself. Now, according to a story earlier today from the WSJ, the FDIC is having another crack at an auction.

The difference this time around is that, because the firm's failure has been deemed a threat to the financial system, it gives the FDIC the flexibility to add in more sweeteners to the deal to try to get it done, including potential offers to mitigate the buyer taking on full liabilities and losses, says the WSJ.

Meanwhile, the future SVB Financial -- the holding company whose stock had been publicly traded before Friday -- is inching into its next phase. It looks like it has a number of suitors for the rest of its business, including some big banks but also major financiers like Apollo (which incidentally also owns Yahoo, which in turn owns TechCrunch.) Read more of our SVB coverage here.

Older article continues below.

Silicon Valley Bank Financial, the publicly traded holding firm of Silicon Valley Bank, has paused trading this morning pending an announcement. The latest, from the typically reliable market tracker Deltaone, is that it's sent out a memo to employees advising them to work from home until further notice as it engages in "conversations to determine next steps for the bank."

$SIVB TELLS EMPLOYEES THERE ARE CONVERSATIONS TO DETERMINE NEXT STEPS FOR THE BANK, STAFF SHOULD WORK FROM HOME UNTIL FURTHER NOTICE-MEMO

— *Walter Bloomberg (@DeItaone) March 10, 2023

The notice comes on the heels of a report in CNBC earlier today saying that the firm is in talks to sell itself.

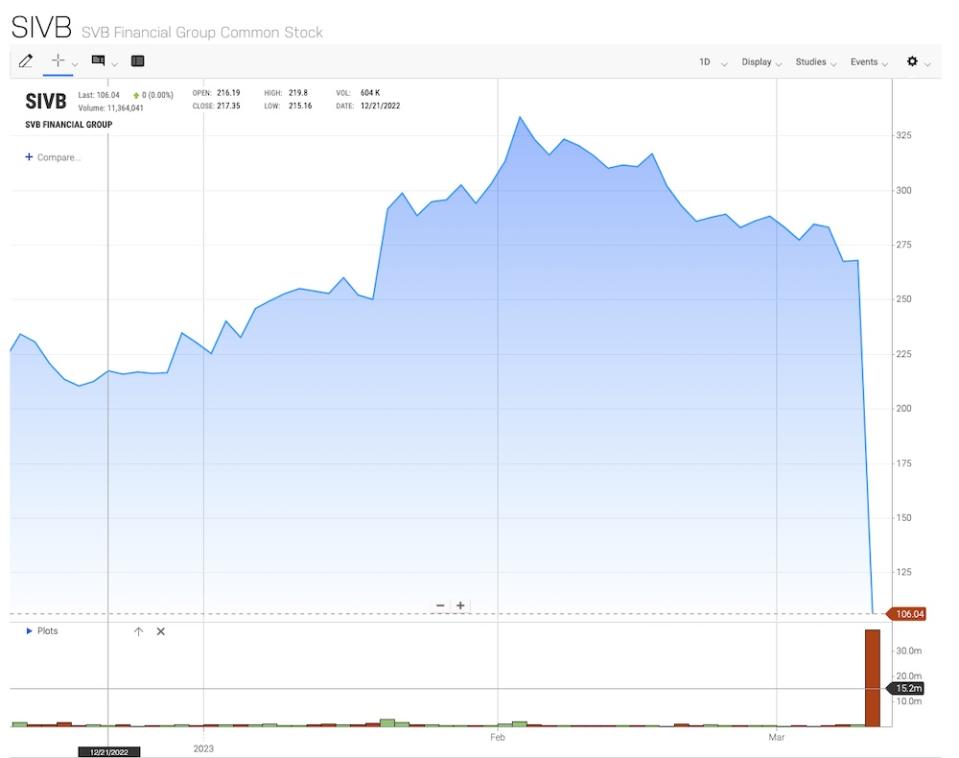

The developments are the latest troubling turns for the technology-focused lender in what has been a surprising, precipitous downfall.

SVB -- the bank for many Silicon Valley startups and other power players in the sector -- has grappled with a number of issues, all in quick succession: rising interest rates, mounting losses, messaging its state of affairs to the market and, most recently, a run on the bank, with a rush of customers pulling their money out.

Yahoo Autos

Yahoo Autos