After 11 Years of Work, GM-Honda JV Is Producing, Selling Fuel Cells

The 70,000-square-foot manufacturing plant jointly owned by GM and Honda has been producing salable fuel-cell modules for about a month, with a plan to build and deliver several thousand by year’s end.

Honda will take 2000 of these fuel-cell modules, which are about the size of a fully dressed four-cylinder engine, and about a quarter of those will go under the hood of the Honda CR-V by 2025.

The JV is focusing on powertrains for Class 8 trucks, and GM says one of its first customers is Autocar, which will use these fuel-cell modules for terminal tractors, refuse haulers, dump trucks, and other “severe duty” vehicles.

It’s been 11 long years since General Motors and Honda began discussing joint development and production of hydrogen fuel cells on the path to a zero-emissions future, and today that relationship is finally bearing fruit at an industrial park southwest of Detroit.

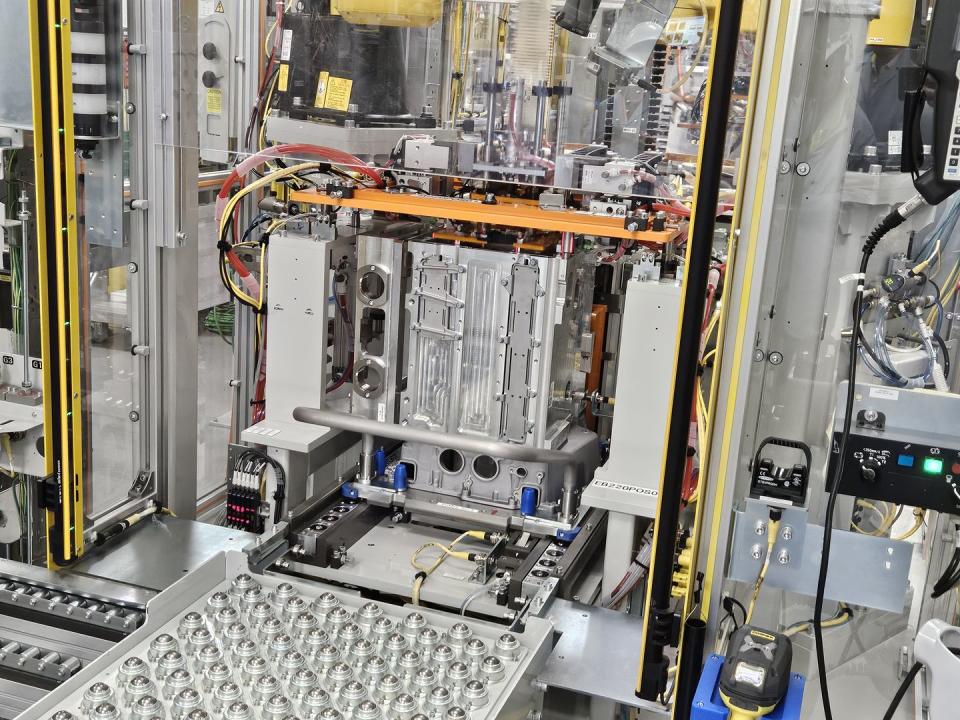

Here, near the Brownstown Township, Michigan, plant where General Motors assembles batteries for electric vehicles, a 70,000-square-foot manufacturing plant jointly owned by GM and Honda has been producing salable fuel-cell modules for about a month, with a plan to build and deliver several thousand by year’s end.

Honda will take 2000 of these fuel-cell modules, which are about the size of a fully dressed four-cylinder engine, and about a quarter of those will go under the hood of the Honda CR-V by 2025. These hydrogen-powered CR-Vs will be configured as plug-in hybrids, but with a fuel-cell stack instead of an internal-combustion engine.

Honda’s ultimate goal is to generate demand for up to 60,000 fuel-cell systems per year, by 2030, extending well beyond passenger cars.

Despite these concrete developments, it’s easy to cast a skeptical eye on fuel cells, which create electrical energy by converting hydrogen gas and oxygen into water. Fuel cells have been touted by automakers globally for years but have always seemed at least five years in the future because of inadequate hydrogen refueling infrastructure and the high cost of the technology.

Also, this production launch is several years late. When Honda and GM announced this formal joint venture in 2017, they said production would begin in 2020. That was also the first year of the COVID-19 pandemic, which was a factor.

But what this new Fuel Cell System Manufacturing LLC plant in really represents is a new approach to the hydrogen economy.

For years, automakers had been banking heavily on passenger vehicles like the Honda Clarity, Toyota Mirai, Hyundai Nexo, and multiple GM concepts, including the 1966 GM Electrovan. Most recently, BMW has developed an iX5 Hydrogen SUV that is currently being road tested globally.

Instead, this FCSM JV is focusing more broadly on powertrains for Class 8 trucks, and GM says one of its first customers is Autocar, which will use these fuel-cell modules for terminal tractors, refuse haulers, dump trucks, cement rollers, and mining trucks. And there are many more potential applications, such as stationary power stations and forklifts.

Class 8 Trucks Already Heading Toward Hydrogen

This strategy makes more sense because these “severe duty” applications, which have contributed significantly to greenhouse-gas emissions with internal-combustion engines, can generally be refueled at a central depot owned by the company using these vehicles.

There’s a business case (not to mention regulatory prodding) for companies investing in both fuel-cell vehicles and the necessary refueling infrastructure.

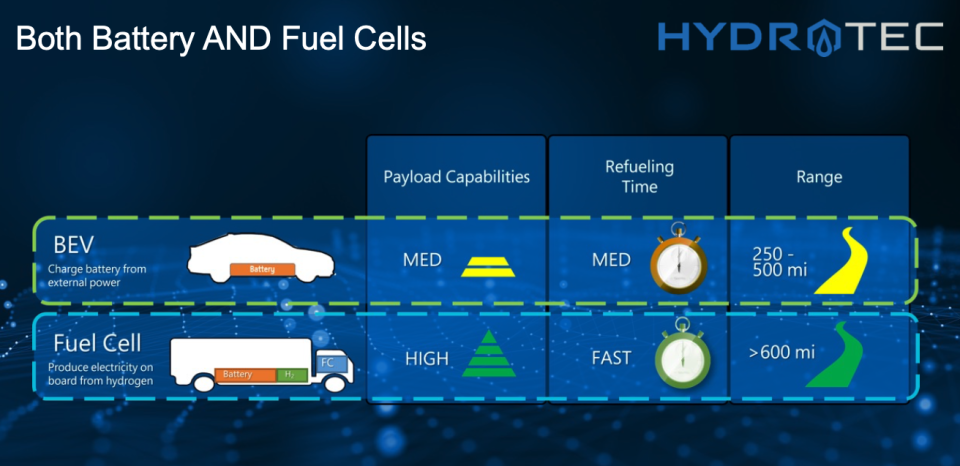

That business case also extends to Class 8 heavy-duty on-highway semi-trucks as Toyota, Hyundai, Daimler, Nikola, Kenworth, Volvo, and certain Chinese brands aggressively pursue converting fleets to hydrogen fuel cells, which can handle heavier payloads and deliver longer range and quicker refueling than similar battery-electric offerings, like the Tesla Semi.

While the Honda CR-V will need just one of these fuel-cell modules (with rated output of about 80 kW, or 107 hp), the larger Class 8 trucks or other heavy-duty applications will use two or three.

Range for these vehicles depends less on how many fuel-cell stacks are onboard a truck but more on the storage capacity for fuel. Honda is talking with a Class 8 customer that is considering a package to deliver about 1000 miles of range with the new FCSM fuel cells, says Jay Joseph, vice president of sustainability and business development for American Honda Motor Co.

As for stationary applications, Honda has already daisy-chained eight of these fuel-cell modules (with a total output of 576 kW) as a backup power system for the data center at the American Honda campus in Torrance, California.

So, why not focus more intently on hydrogen-powered passenger vehicles?

“Because there’s not enough retail hydrogen fueling infrastructure outside of California to really concentrate on sales,” Joseph tells Autoweek at yesterday’s event in Brownstown Township.

“There are some spots in New York, and I think there’s still a station or two in Washington, D.C. There are a couple locations around the country, but the real concentration is in California,” with about 70 public hydrogen fueling stations currently.

Tempered Expectations

This reality—along with the consumer market tipping more heavily toward battery-electric vehicles—has forced automakers like Honda to pivot.

“We’ve tempered our expectations,” Joseph says. “This (current fuel-cell strategy) is not displacement for large volumes of ICE or battery-electric (powertrains).”

Feeding optimism for fuel cells in the US are joint investments by the departments of Transportation and Energy in a hydrogen corridor across the Great Plains so Class 8 trucks can refuel on cross-country trips.

That doesn’t necessarily mean good news for passenger cars, because light-duty and heavy-duty fuel-cell vehicles refuel at different pressures. Class 8 trucks would refuel at 70 kilopascals, compared to 35 kilopascals for passenger cars, requiring different dispensing equipment, Joseph says.

Nikola’s HYLA hydrogen refueling stations are focused on Class 8 trucks, but a company spokeswoman says some of those US stations are being equipped to refuel light-duty FCVs as well.

For Charlie Freese, executive director of GM’s Global HydroTec business unit, fuel cells present a good alternative to diesel engines, which have been the workhorse for heavy trucks and off-highway equipment for generations. Battery-electric powertrains alone cannot handle the breadth of so many applications, he says.

“You’ve got to have a leadership position in hydrogen fuel cells… to really solve the problems across a wide portfolio. The largest of these vehicles absolutely will require this technology,” he tells Autoweek.

While he does not foresee diesel engines going away soon, Freese says it will become increasingly difficult (and certainly more expensive) to equip diesel engines to meet emissions requirements globally.

“You add a lot more complexity to it, and after-treatment systems can cost thousands of dollars and are precious-metals dependent,” Freese says of the platinum, palladium, and rhodium needed to treat emissions.

Fuel-Cell Costs Are Falling

But this latest generation fuel cells from FCSM requires no palladium or rhodium and only a quarter of the 80 grams of platinum that were used in GM’s Project Driveway fuel-cell vehicles in 2007. At that point, the new fuel-cell system rivals the precious-metals cost for a diesel after-treatment system, he says.

Although this GM-Honda JV is a long way from posting a profit, Freese says the two automakers working together keeps the costs down. “We’re trying to get to where we can together as two OEMs develop one common set of suppliers,” he says, “so that it’s not two companies with their independent volumes, running that lower volume, trying to source through a very small supply base, in some cases.”

Also on the cost front, this newest jointly developed fuel-cell system has twice the durability as the previous Honda Clarity FCV technology, while costing two-thirds less to produce, Joseph says.

In Japan, the Giga Fuel Cell truck jointly developed by Honda and Isuzu is slated for production in 2027, with initial demonstration on public roads starting within the next two months. In the US, Honda is preparing a proof-of-concept Class 8 hydrogen-powered fuel-cell truck as well.

GM and Honda have together invested $85 million in this highly automated plant, which is functioning with one shift currently and 80 employees, about half of them production workers represented by the United Auto Workers union.

Long term, Joseph says Honda still sees the need for more than one powertrain solution, including hybrids, BEVs, and fuel cells.

“Storing energy in a battery and dispensing electricity is more or less difficult in different parts of the world,” he says. “And the distribution of hydrogen that can be stored in tanks that can be transported is easier for some places and some applications.”

Joseph is confident the next generation of fuel cells will present an even more compelling business case. “We’re building a business,” he says, “and we’re in this for the long haul.”

Do you view hydrogen fuel cells as viable powertrains for light-duty vehicles? Please comment below.

Yahoo Autos

Yahoo Autos