Was 2023 a Down Year for EV Sales? They Grew 46% over 2022

The auto industry ended 2023 with EV inventory of 113 days, compared with (a more common) 69 days for internal-combustion-powered vehicles, including hybrids. (All-electric Mercedes EQE pictured above.)

Cox analysts began last year predicting EV sales would top 1 million in the US in 2023. By Dec. 31, we had purchased or leased 1.1 million, representing year-over-year growth of 46%.

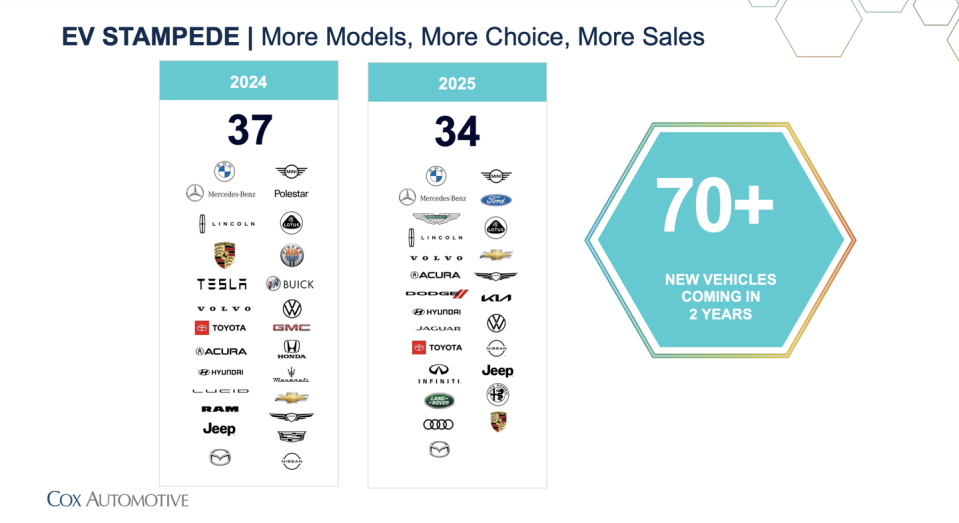

“With so many new models in the marketplace and so much enthusiasm around the world, many believed the market was ready to convert completely,” said Sam Fiorani, vice president at AutoForecast Solutions.

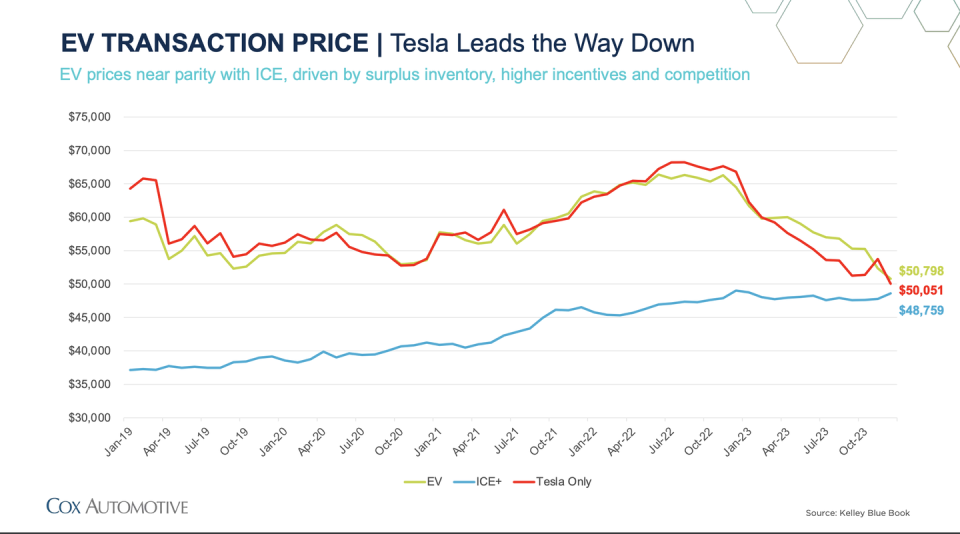

Last year American consumers discovered the shortcomings of electric vehicles, letting them pile up on dealers’ lots as many turned their purchase intentions toward hybrids and plug-in hybrids.

The auto industry ended 2023 with EV inventory of 113 days, compared with (a more common) 69 days for internal-combustion-powered vehicles, including hybrids, said Cox Automotive in its Industry Insights 2024.

Cox analysts began last year predicting EV sales would top 1 million in the US in 2023. By Dec. 31, we had purchased or leased 1.1 million, representing year-over-year growth of 46%. There was market-softening earlier in 2023.

“If you look at the fourth quarter, it was a record year for volume,” said Stephanie Valdez-Streaty, Cox Automotive director of industry insights. EV market share ended ’23 at 7.6% of total volume, though it reached 8.1% for the fourth quarter alone.

Tesla sold 654,888 of those EVs, according to Cox’s estimate of US sales (the EV-maker reports only global sales, not sales by country).

A chart published by The Wall Street Journal on Dec. 27, using Motor Intelligence data, compares that 46% growth rate with a much-better 2022. April 2022 EV sales were up 76% over April 2021, and EV sales were up 74% in November ’22 over November ’21.

A caption under the chart reads: “Electric-vehicle sales growth hit a speed bump in the US this year, and the impact is being felt throughout the industry.”

Cox Automotive expects this year’s EV sales in the US to reach 1.5 million, about 36% higher than last year, though also equal to roughly 9.6% of Cox’s projected US vehicle sales of 15.7 million.

“I think the key thing is the infrastructure,” Valdez-Streaty said, noting that EV owners currently do 80% of their recharging at home. She does not expect intended buyers to hold off EV purchases until most major automakers switch to the Tesla Supercharger standard, however.

“We’re definitely on the electrification road. There may be some potholes, but I don’t think there’s going to be negative impact,” Valdez-Streaty said.

“With so many new models in the marketplace and so much enthusiasm around the world, many believed the market was ready to convert completely,” said Sam Fiorani, vice president for global vehicle forecasting, AutoForecast Solutions, via email.

“As the initial wave, powered by tech-savvy ‘early adopters’ has become saturated, automakers and dealers need to turn their attention to more reluctant consumers,” Fiorani said.

“The next group of buyers like the idea of an EV but have some reservations such as range anxiety, belief that there isn’t a place to recharge their vehicle, and simply fear of the unknown.”

General Motors sold 75,883 battery-electrics, 62,045 of them the outgoing Chevrolet Bolt/Bolt EUV that is to be replaced by a new Bolt lineup on the automaker’s Ultium platform.

CEO Mary Barra announced at the end of 2022 that GM would assemble 70,000 Chevy Bolts by December 2023, so it ostensibly became a “buyers’ car” with production for the year outpacing sales by nearly 8000 units.

The 70k production Barra announced for 2023 almost certainly was a “buildout” to use up parts and components that GM already had in the pipeline or under contract, many of which would not work in any Ultium model.

When it does change to that common platform, it is believed the Bolt will have much better profit margin than the discontinued car.

Same for the Ford F-150 Lightning, which is built on a conventional internal-combustion F-150’s platform. Ford said it sold 72,608 EVs last year, 24,165 of them Lightnings (+54.7%) and 40,771 Mustang Mach-Es (+3.3%).

Ford is re-emphasizing hybrids and plug-in hybrids as its second-generation electrics start to roll out, and as engineers commence working on third-generation EVs, CFO John Lawler told Barclays Automotive and Mobility Tech Conference in New York late last November.

Gen III EV technology will make it far less economically attractive for the company to sell the costlier ICE-based Lightning and even the current Mach-E dedicated electric.

Meanwhile, at GM, CFO Paul Jacobson told the same conference (in a separate discussion) that the company probably will not reach its goal of producing batteries at a cost of $87 per kilowatt-hour by 2025 as rare material prices remain volatile, though it still expects to produce 1 million EVs in North America next year.

Nevertheless, GM’s 76k EVs sold last year fell far below the company’s expectations, and Barra, who has led the company’s EV push for pretty much all of her decade as its CEO, is the subject of industry speculation that the shortfall could cost her the job.

GM assembled just 13,838 Ultium-based EVs last year and has blamed the automated machinery purchased to pack cells into modules for the slow start-up.

The Chevrolet Silverado EV has sold only in its expensive “launch” trim so far, and a Chevy Blazer EV (which is on hold for sale while electronic glitches are addressed) will save you only a couple thousand dollars off the price of a Cadillac Lyriq EV.

Much of Barra’s job insecurity could be blamed on GM’s $8-billion investment into its failing Cruise robotaxi business, but those vehicles are BEVs, too. EV and AV development often are seen as hand-in-hand, in part because of Elon Musk’s advocacy of Tesla’s Autopilot technology.

The greatest obstacle to converting the US auto fleet from internal combustion to battery-electric might be cultural, political, and economic forces, culminating in failure by the COP 28 conference in Dubai last December to sign a commitment to phase out—or even phase down—fossil fuels.

“There is a growing undercurrent of anti-EV buyers, companies, and politicians,” said AFS’s Fiorani. “Misinformation and a simple lack of information are fueling these groups to dig their heels in and not make the conversion.”

EV registration fees were raised to $200 per year in Texas last September, Politico reported Aug. 18, and a new registration in the state would cost EV buyers $400. Washington, Wyoming, Ohio, West Virginia, Arkansas, Alaska, and Georgia were already at $200 or more annually, according to the report, to compensate for diminished gas-tax revenue used to pay for road repair and construction. Texas has one of the cheapest gas taxes in the nation, unchanged since 1991, the article notes.

Consider it a minor victory, then, against those trying to put the brakes on the EV revolution that a bill introduced last January in Wyoming’s state legislature to ban sales of electric vehicles there by 2035 died in committee last February.

If EV sales didn’t grow as quickly as expected in the US in 2023, do you think the market can build more momentum in 2024? Please comment below.

Yahoo Autos

Yahoo Autos