Auto Loans Are Going Unpaid, But Who’s Not Paying?

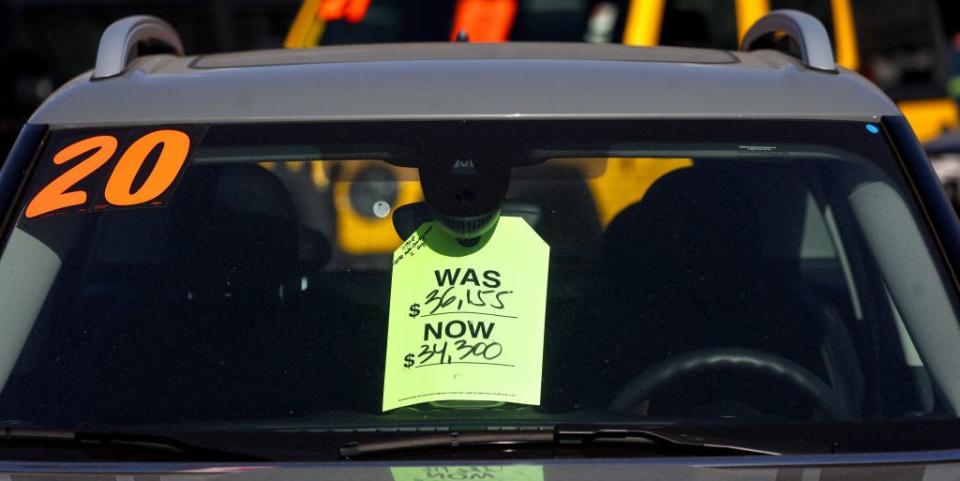

Average prices for both new and used cars remain high, and the level of auto loan debt has risen by hundreds of billions of dollars as a result.

As interest rates continue to climb, consumers with car notes are struggling to pay, with Gen Z and millennial borrowers accounting for nearly $20 billion in delinquent auto loan payments.

Insurance premiums and the cost of service and repairs are also on the rise, adding further expense to car ownership and spurring young consumers to think outside the box for their transportation needs.

It's a well-known fact that buying a car isn't exactly easy right now. Week after week, news of material shortages, plant shutdowns, and fluctuating prices inundate consumers, as experts say "I'd wait if I were you." For the most part, this is and has been sage advice, but not everyone was able to weather a three-year-long industry storm.

Though a small subset of car shoppers managed to secure low-price, low-interest deals at the onset of 2020, the majority of car purchases over the last three years have been above sticker price with high-interest rates adding insult to injury.

In fact, 43% of Generation Z consumers said they had bought or leased their current vehicle since 2020, according to an analysis of the Federal Reserve's Quarterly Report by Jerry. And while dealerships have markedly profited from this group of buyers, the banks that financed these deals are now dealing with the consequences.

Specifically, analysis of Federal Reserve data from 2022 showed that drivers ages 18-39 accounted for nearly $20 billion in delinquent auto loans over 90 days past due. This concerning trend falls in line with the total outstanding debt held by people under 30, with a 37% rise since the pandemic started and a $1.27 trillion deficit at the end of 2022.

But how exactly did young folks rack up so much auto loan debt? The answer is complicated, but continued high prices for both new and used vehicles are a big part of the problem. The total dollar value of auto loans taken out by consumers under the age of 40 has grown at an alarming rate, with the value rising at the fastest pace on record since 2000.

Specifically, Gen Z consumers have added about $50 billion in auto loan debt since 2020, while millennial consumers accounted for an additional $80 billion in car notes in the same period.

That's an auto debt growth of 31% for Gen Z and 29% for millennials. By comparison, consumers ages 40 to 49 have added around 23% more auto loan debt since 2020, while those ages 50 to 70+ years old have only borrowed anywhere from 11% to 14% more.

Before you rush to blame irresponsible, coffee-buying young car owners for defaulting on their car notes, data shows the cost of owning a car eats up a significant portion of both Gen Z and millennials' annual income, and much more than it does for older generations.

In fact, around 40% of Gen Z and millennial borrowers currently have monthly payments that are 16% or more of their household's take-home pay. And more than 10% of Gen Z borrowers are paying a car note that is anywhere from 41% to 50% of their gross pay.

To put that in perspective, 60% of baby boomers spend less than 10% of their take-home pay on monthly expenses, while the comparative percentage for Gen X borrowers is around 40%. Meanwhile, the average used car interest rate in the US is sitting at 10.57%, while the average new car rate is 6.92%, according to data from Edmunds.

Additionally, a whopping 52% of Gen Z car owners said they have purposefully missed on-time payments of other expenses, such as rent or credit card statements, in order to pay their car notes in full. And 33% of millennial car owners employed the same tactic, according to surveys done by Jerry.

This phenomenon perhaps emphasizes the lengths to which young people are going to have reliable personal transportation, depending on whether public transit or less expensive personal transit is available to them.

"Before the pandemic struck, the rise in auto loan delinquencies had created concerns about a possible wave of defaults. Pandemic-driven government stimulus measures helped consumers gain a stronger footing and delinquencies plummeted," said Henry Hoenig, a data journalist at Jerry. "Now they have returned to and even surpassed pre-pandemic levels. This is especially true among borrowers with lower credit ratings, though their overall share of the auto loan pool plunged in recent years as banks tightened lending standards, reducing the risk of massive defaults."

It's hard to deny that the financial outlook for current or prospective young car owners is grim. And part of the reason is that it's not just the car itself that is expensive. Beyond generally high inflation, climbing car insurance rates as well as higher repair costs are adding expense to the ownership experience.

According to a consumer survey done by Deloitte regarding 2023 buying practices, around 10% of used car buyers were swayed by cheaper insurance premiums, in an effort to keep initial and continuing costs low.

Consumers who are or could be affected by rising automotive costs are starting to look for alternatives. At least that's what around 10,000 global respondents said in a recent report from Deloitte, specifically focusing on the future of automotive and transportation technology.

For example, the survey found that more than one-third (38%) of 18- to 34-year-olds in the US question their need for personal vehicle ownership, in part due to rising costs. Additionally, as subscription models re-emerge, around 51% of US respondents expressed interest in making one monthly payment that covers vehicle-related costs, including insurance and maintenance.

Have rising interest rates discouraged you from purchasing a vehicle? Please share your thoughts below.

Yahoo Autos

Yahoo Autos