Batteries Not Included: Is Pack Swapping the Reboot that Affordable Electric Vehicles Need?

Most, if not all, of the issues regarding why electric-vehicle ownership doesn’t pencil out point back to a single key component: the battery pack. Lithium-ion battery packs, which can cost more than $10,000, are central to why EV ownership can add up to more than for equivalent gasoline models. Depreciation happens at alarming rates, too, mostly because of concerns over the pack’s declining range, and worries persist about their eventual disposal.

Bargain-priced subsidized leases through automakers’ captive finance arms tend to work around that. But, given the need to amortize an expensive battery pack, they can only go so far. One potential answer to this conundrum is to take the battery out of the equation-by selling or leasing the vehicle without the battery included, then letting the owner essentially subscribe to a guaranteed supply of batteries.

That’s already happening in China. Beijing Electric Vehicle Company (BJEV), the top electric-car producer in China, earlier this month revealed a version of its budget EV300 small car, priced at the equivalent of about $11,700, with unlimited battery swaps allowed on a monthly battery subscription of about $64.

Batteries on Demand

Although BJEV has no stated intent to enter the U.S. market, one Chinese brand that does, Nio, is aiming for a similar plan in its home market. There, its Power Mobile service vehicles and temporary battery-swap stations would help drivers swap power packs quickly, in a location that makes the best sense without interrupting their driving patterns. As of earlier this month, Nio intends to have more than 1200 vehicles and more than 1100 stations up and running in China by 2020.

We reached out to Nio for an update on whether its U.S. plans might include battery swapping. The automaker responded that although the company maintains a Silicon Valley office focused on advanced technology development, for now the company’s priorities are to “ensure quality and deliveries of the Nio ES8 [the electric crossover vehicle it might sell in the U.S. market] and the services such as battery swapping that go along with it for the China market.”

The logistical hurdles of such schemes are central to a paper supported by China’s National Science and Technology Support Program, also presenting a plan through which vans would “carry tens of fully charged batteries and drive to an EV to swap a battery within a relatively short fixed period of time.” But the logistical hurdles are daunting. Other experts have anticipated that for each vehicle, there would need to be at least two good battery packs in use in order to cover the time spent charging the packs, storing them, and moving them to where drivers might next need them.

Heavy Lifting

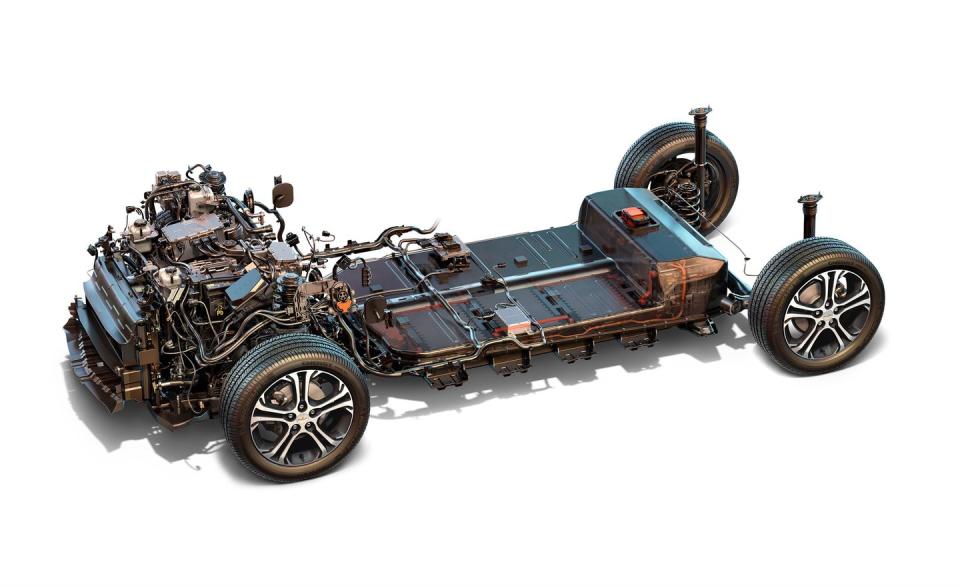

And, physically, the task of swapping batteries on any regular basis is a little more involved than that recurring delivery you’re getting from Amazon. Battery-swap operations would likely need to raise the vehicle and then lift and position battery packs that can weigh hundreds of pounds. The 60-kWh LG Chem battery pack in the Chevrolet Bolt EV, for instance, weighs 960 pounds.

It has actually been done before, however. Earlier this decade, a well-backed company called Better Place designed an entire ecosystem through which the company could swap out a nearly dead battery (with proprietary hardware) and install a fresh one in just a couple of minutes. But massive infrastructure costs and expensive installation costs for those battery-swap stations kept that effort from catching on.

Tesla, too, conceived a 90-second battery-swap process for its Model S, but it noted a lack of demand for the service as the reason for abandoning the idea after a limited pilot program. Although that system relied on a permanent installation, Tesla last year showed signs that it was also looking into a mobile method, with documents proposing a battery-swapping rig that could be custom built onto a trailer.

Scaling It Down for the (Near) Future

But the idea of lighter, more mobile battery swapping does have some new life, and there has been a new round of partnerships formed around it. Earlier this year, the startup Japanese EV maker Fomm and the established technology supplier Fujitsu entered an alliance aimed at developing what it calls a Battery Cloud Service; it would give users the choice between charging batteries at home or exchanging a depleted one for a fully charged pack at a service station in just five minutes. The partnership will start with a battery solution that provides a very small four-wheeled urban EV, to be sold in Thailand initially, with a 100-mile driving range.

Honda earlier this year revealed the Mobile Power Pack World-intended for a wider ecosystem that could be used to power a home in a power outage, a work site, or a campsite. Its partner in the effort is Panasonic, which is also the official supplier of lithium-ion cells for Tesla vehicles and Tesla’s partner in the Gigafactory that supplies them. And then this month Honda announced a first “research experiment” with the Mobile Power Pack in Indonesia, where it will be given a market test in electric motorcycles and other mobility products. At charging-station kiosks, users will be able to exchange their battery instantly for a fully charged one.

At this point it would be a competitive disadvantage-and, perhaps, a new challenge for safety regulations-to sell or lease a U.S. electric vehicle without a battery pack, as the federal EV tax credit is dependent on the car’s battery capacity. But as the tax credit phases out for Tesla and others and the ownership model evolves, separating batteries from the equation could give electric vehicles a boost in the market-and the phrase “batteries not included” might then be the future, not the past.

('You Might Also Like',)

Yahoo Autos

Yahoo Autos