Bollinger Scraps Plans to Build Its $125,000 B1 and B2 Electric Trucks

Bollinger Motors first showed off its consumer-intended SUV and pickup truck, dubbed B1 and B2, back in 2019, and had originally planned to begin deliveries last year.

The company now says it is “pausing” development of the B1 and B2 and is instead turning its attention to building platforms aimed at class 3 through 6 commercial vehicles.

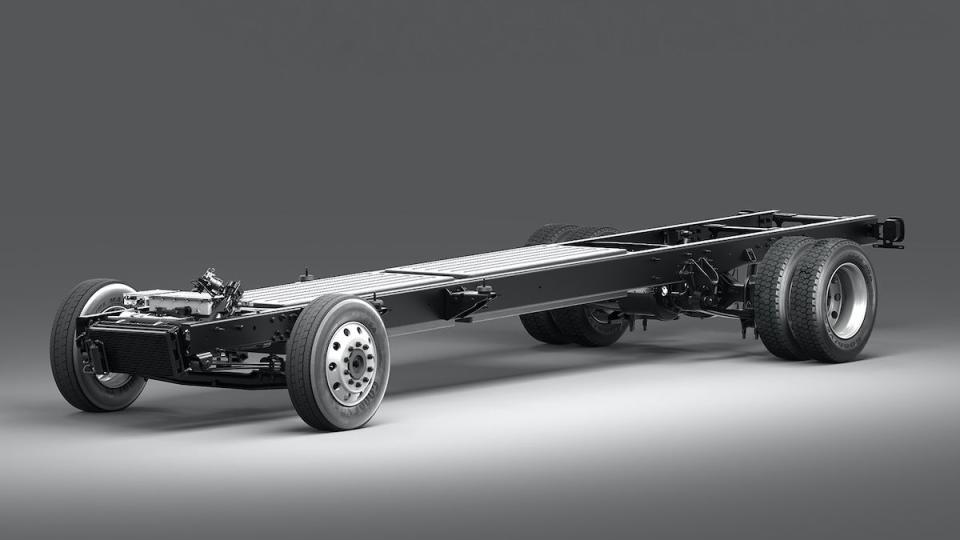

These electric chassis would need cabs and bodies built by partners, and the first examples will likely not be available until 2023 or shortly thereafter.

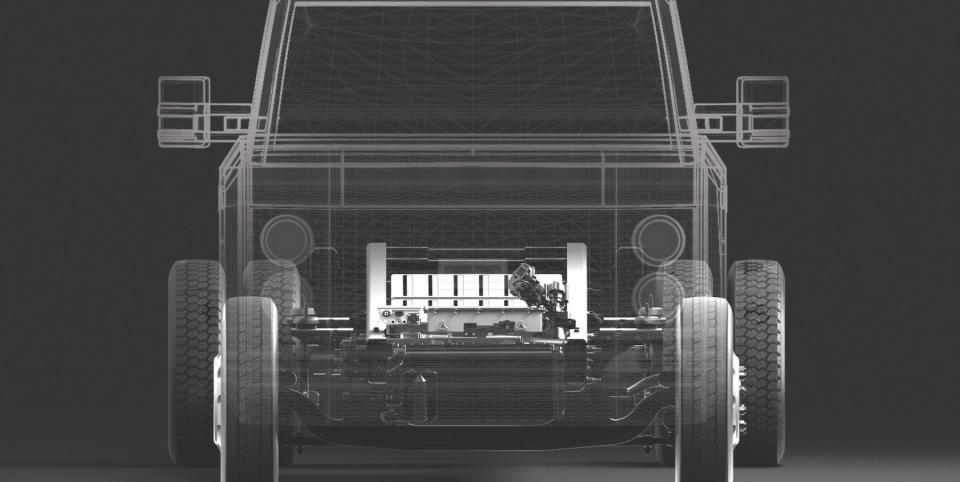

The Michigan-based Bollinger Motors, which had been on track to deliver its first $125,000 electric vehicles, the B1 (SUV) and B2 (pickup), later this year, announced January 14 that it would cease development of those vehicles and would instead pivot to making skateboard-type electric chassis for commercial Class 3 through 6 trucks. The target date for delivery of these chassis, which would have cabs and bodies built by partners, is 2023 or shortly thereafter.

In an interview with Autoweek, CEO Robert Bollinger said that his company, launched in 2015, has been seeing high demand on the commercial side as “fleets need to go green and electric—it’s pulling in that direction. The decision was not easy, but it was the right one to help us grow.”

Bollinger said the company is talking to potential “big name” partners. He said that the battery packs, chassis, controls, software, and other components it developed for the B1 and B2 can be adapted into “strong, durable, cost-effective platforms for truck classes 3 to 6, representing a big swath of commercial fleets. We’re not just throwing our hat into this space. We’ve been working on commercial platforms for the last year and a half.”

The company has been taking $1000 deposits for the B1 and B2, and Bollinger said these will be returned. Bollinger has said its first-full-year target was 1000 units, with 80 percent of them B1 SUV and 20 percent B2 pickup.

Since that 2015 launch, a once wide-open marketplace for electric SUVs and pickup trucks has become crowded. At the just-concluded CES, General Motors announced the Chevrolet Silverado electric pickup for delivery next year, with up to 400 miles of range and a price that will eventually start at $39,900. That complements the Ford F-150 Lightning, an electric version of America’s best-selling vehicle. It too has a starting price just below $40,000, with deliveries slated for later this year.

Bollinger said that, notwithstanding these much lower prices, he still saw a market for his off-road-oriented electric vehicles. “Our vehicles have features not on any of the vehicles coming out,” he said. “They are very different, extremely unique. We still think there was room for cool, niche trucks.” In a statement, Bollinger called his B1 and B2 “powerful, innovative and distinct.”

According to Jessica Caldwell, executive director, Insights, at Edmunds.com, “The starting price points for the electrified F-150 and Silverado have suddenly transformed the EV pickup segment from a brand-new space to a highly competitive one. These trucks are the most established, widely recognized nameplates in the U.S. and therefore any attempt at competing with these vehicles is going to be a challenge, even for contenders with deep pockets.”

The B1 and B2 made it through three prototype stages, but Bollinger said that further development was needed to finalize them for manufacturing. “This was a necessary, smart decision,” he said. “We need to focus on one thing rather than get spread too thin.”

Caldwell agrees with that logic. “Bollinger is making a smart move by pulling out, as it would only be an uphill battle for the company on all fronts. The economies of scale that Ford and Chevrolet can achieve are not something easily done, which puts Bollinger at a great and immediate disadvantage.”

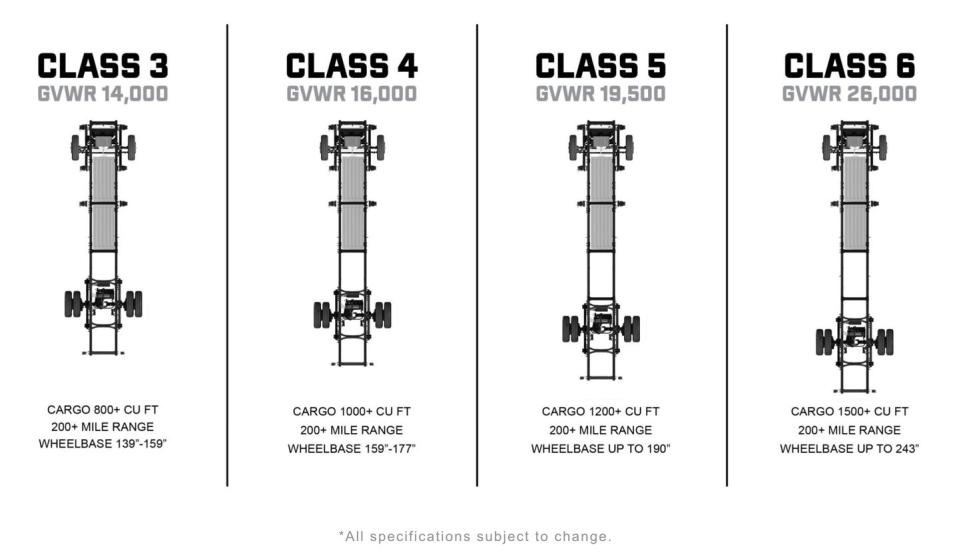

The truck classes Bollinger is targeting are medium-duty vehicles in the 10,000 to 26,000-pound weight class. GM, Ford, Freightliner, Kenworth and Peterbilt and others make internal-combustion vehicles in these classes. Bollinger said his platforms—with 70-kilowatt-hour battery packs that can be paired or tripled for 140- or 210 kilowatt-hours—might be used for, among other things, box trucks, municipal buses, chassis cabs, bucket and tow trucks.

Bollinger said that because its sales will be business-to-business transactions, no pricing will be announced. In a statement, he said, “Bollinger Motors will be working closely with fleets to customize the platforms' battery-pack size, wheelbase length, gross vehicle weight rating (GVWR), and other specifications to meet the fleets’ needs, which will determine the price point.”

Rivian, Arrival, General Motors’ BrightDrop division, Stellantis with its Ram ProMaster, and others are all building electric delivery vehicles and are signing up customers. “That field is very crowded, but we’re going bigger than that,” Bollinger said. “We hope to be in fleets within the next few years.”

Share your thoughts on Bollinger's announcement its pulling the plug on its consumer trucks to focus on building platforms for commercial buyers in the comments below.

Yahoo Autos

Yahoo Autos