Brown on Arrow McLaren’s present and future

As McLaren Racing contests its fifth season in the NTT IndyCar Series under the Arrow McLaren banner, its CEO, Zak Brown, is actively tracking where the program stands and where the team could be headed.

Currently fourth in the championship with Pato O’Ward and fifth with Alexander Rossi, Arrow McLaren is in the thick of another title fight. They’ve been joined by rookie Theo Pourchaire, the reigning Formula 2 champion, who’ll complete the rest of the season in the team’s third car.

Thanks to substantial, ongoing investments from McLaren, Arrow McLaren has grown to field three full-time entries, plus a fourth car at the Indianapolis 500, and has become a routine winner and title contender since McLaren’s arrival in the sport. Its trio of Chevrolet-powered cars are also blanketed with sponsor logos, which speaks to McLaren’s transformational influence on the Indiana-based effort.

Even with its significant progress, the team continues to pursue its first Indy 500 victory and to crown its first champion. Now five years in, and despite the challenges to reach its full potential, Brown says there’s no end in sight for Arrow McLaren in American racing.

“We just acquired Andretti Global’s facility. We’re going to move into it next year and make a substantial investment in what is already a great building. We’re fully committed to being in Indianapolis,” Brown told RACER ahead of this weekend’s Formula 1 Canadian Grand Prix and Road America IndyCar races. “That commitment extends to our wider presence in North America and this team over the long term. Our decisions are driven by what’s in the best interest of our team and sponsors. Those are the key stakeholders we look after: Our people, our sponsors, and our fans. It’s the foundation here that has already brought the great success we continue to build upon.”

A Los Angeles native, Brown fell in love with racing at an early age, attending the Long Beach Grand Prix where his passion for the sport — with F1 and IndyCar serving as early influences — led to driving in junior open-wheel training categories before turning his attention to the industry’s business side. Through the formation of Just Marketing International, Brown and his company became known for its blockbuster sponsorship deals struck between major corporations, teams and racing series.

When McLaren asked Brown to lead and rehabilitate its F1 program in 2016, he developed an expansion plan to implement once its grand prix organization regained its form. Spurred by his lifelong passion for IndyCar, McLaren’s first move was the creation of a domestic open-wheel program in the U.S. within IndyCar. Further expansion came when the team joined the all-electric FIA Formula E and FIA Extreme E championships.

Brown keenly monitors McLaren Racing’s cadre of worldwide racing initiatives, and as such, he has strong opinions on which sanctioning bodies are trending up or down.

Phillip Abbott/Motorsport Images

“I’ve always been a massive fan of IndyCar. It’s got tremendous potential. The Indy 500 is iconic. But in a day and age where everyone’s developing new cars and really focused on growth through digital (social media and streaming), we think that despite its strengths, IndyCar has a lot of catching up to do,” he said.

“The race calendar needs work. We need to ensure that the whole series isn’t contingent upon the Indy 500. We need a schedule with more fullness so that fans don’t tune out after the month of May. The product can certainly use a freshening as well. Formula 1 is known for having new race cars — those annual reveals and updates are immensely important not just to the teams, but to the fans. Domestically, you can look at IMSA and NASCAR and say that everybody’s racing product is being freshened or renewed on a more regular basis.

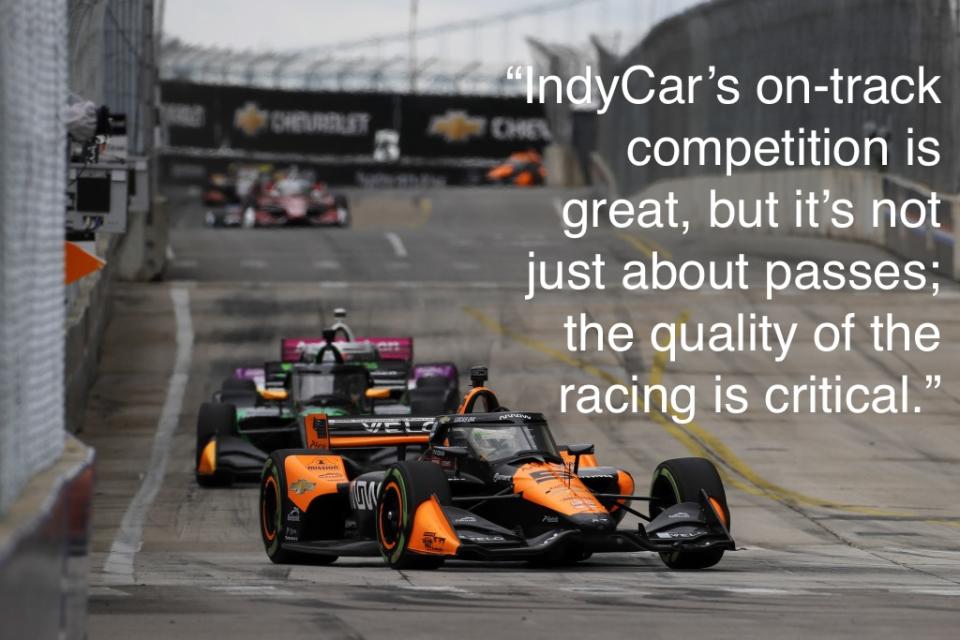

“Certainly, IndyCar’s on-track competition is great, but it’s not just about passes; the quality of the racing is critical. When you have events like we’ve seen at Laguna Seca, and Detroit more recently, we all can say that they didn’t represent the caliber of competition that we expect from the pinnacle of U.S. single-seater racing — certainly not as teams, and certainly not as an entertainment product for the fans we all do this for.”

To that end, IMSA, with its thriving hybrid GTP cars and expansive GT categories, has Brown’s full attention.

“McLaren Automotive loves its presence in North America, and we’re very intrigued by IMSA,” he continued. “Of course, we’re always forward-looking with regard to our racing portfolio. We’re very excited to be in IndyCar, but we expect to see substantial changes here over the next few years because the reality is that our digital growth, our television ratings, our race schedule and our product freshness aren’t where they need to be. Most people recognize that.

“We’re confident that these issues will be addressed. Those are the things that IndyCar must be fully committed to fixing for the long term. At the same time, we think IMSA is doing a wonderful job. It’s got a thrilling modern-day product with exciting races at legendary venues in Daytona and Sebring; they race in Long Beach, Watkins Glen, and they go to Indy now, and they have a tentpole race in Petit Le Mans to conclude the season. IMSA has substantial investment behind it from a wide range of manufacturers; its momentum is real, and there’s room for continued growth.”

Brown is keeping a firm eye on the calendar and the pace of IndyCar’s progress to modernize itself. With the FIA unveiling its new-car plans for 2026 this week, Brown wants to see IndyCar share in his sense of urgency to improve itself.

“Sports in general continue to evolve quickly. Just look at the way baseball has improved itself, and how golf has embraced new thinking as it works to drive the sport forward,” he said.

“If we look at the motorsports landscape, we’ve now just seen the future of Formula 1. We’re seeing the future of sports cars play out in real time. IndyCar has a very strong foundation and brand, but we need to accelerate our efforts to match the growth we’re seeing in other disciplines because we have room for significant improvement.

“We’re excited and optimistic that we’re going to have an increased television package, which is critical to the sport. Our TV ratings are not where they should be, and we can see by Formula 1, as an example, how quickly a sport can grow if you get these dynamics right. Look at Formula 1 and what it’s done on growing its fan base; it’s driven a more diverse, younger and female audience. A lot of that has been achieved through new digital media and we think that’s a real opportunity IndyCar has yet to seize. We should embrace and capitalize on the success Formula 1 has brought to motorsports as a whole in North America.

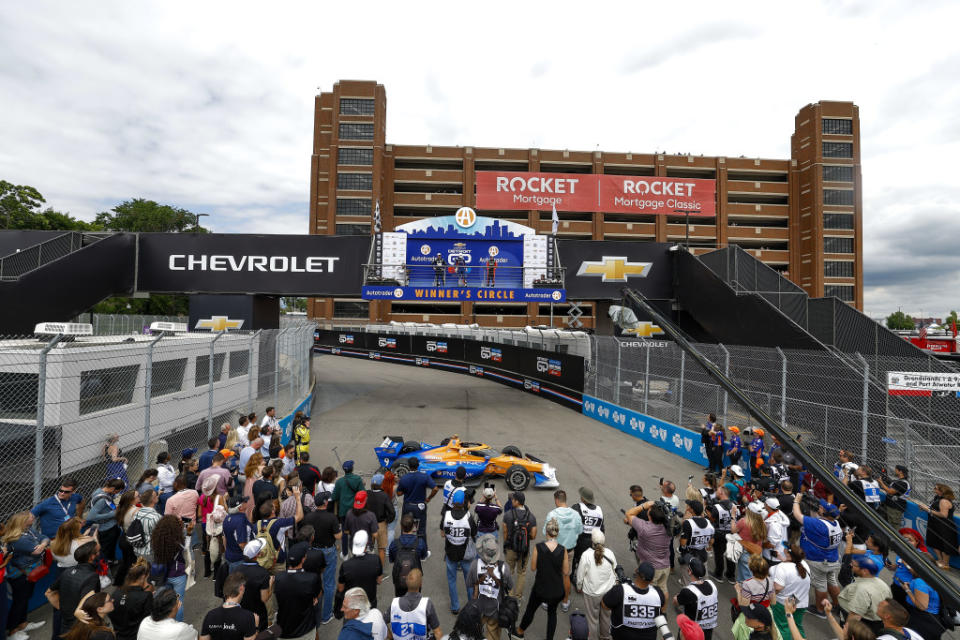

“What might seem like a small point, but we think has been significantly impactful in Formula 1, is proper podiums. We shouldn’t underestimate the attention podium celebrations get and the breadth of broadcast social media imagery they generate. The new podium bridge at Detroit looked great — those are the types of upgrades we want to see more of. There’s a lot we can learn from other sports that we need to apply quickly, because we think we are underserving our fan base.”

Utilizing a bridge over the Detroit street circuit to create a winner’s podium represents the type of creative thinking Brown would like to see more of. Brett Farmer/Motorsport Images

Brown’s narrative on how McLaren chose to enter IndyCar — just prior to the “Drive To Survive” effect that turned F1 into a global phenomenon — is filled with insights and realities that could chart Arrow McLaren’s future path.

“We are always trying to create the most exciting racing team in the world so that we can offer our sponsors a deep, broad commercial portfolio that presents them with many partnership options, especially as corporate partners evolve and change priorities,” he said.

“Likewise, we’re always looking to create opportunities for employee growth. Sometimes that comes within a team, and sometimes that opportunity comes from changing racing series. We’ve done this with people from our Formula 1 team and our Formula E team, moving drivers, sponsors and so on around. This helps us keep up with the fast pace of changing tastes — what’s immensely popular today might not be in the future, and vice versa.

“For example, one of the main reasons we got involved in IndyCar was Formula 1. Formula 1’s presence in North America was lacking not long ago before Netflix worked its wonders. And so when we’d be out selling to sponsors, one of the largest showstoppers was Formula 1 because it didn’t work for most of them in North America. Now look how times have changed. For most of those companies, North America is a huge marketplace, but before it took off like it has, Formula 1 was a problem for us here. Today, we can’t sell Formula 1 fast enough.

Brown sees F1’s expanding popularity with younger fans following directly from its investment in digital media. Sam Bagnall/Motorsport Images

“So we felt getting into IndyCar, which obviously has a long and established name here, would help ring the bell, if you like, for our North American presence. But that’s all changed since Formula 1 exploded in this market. Apart from the Indy 500, Formula 1 pulls larger television ratings than IndyCar. It’s no longer filling a void because the void went away. Now we need to ask ourselves: What else does an IndyCar or an IMSA provide McLaren Racing?”

With Arrow McLaren’s deep commitment to racing in the U.S., the options for where it might compete are based on the value a series can offer.

“For many of our partners, North America is certainly one of, if not the most important market outright. So even with Formula 1 being as big as it is in North America, I want to add another layer to the cake,” Brown said. “We want to be bigger than all of our Formula 1 competitors in North America, so you look at what’s out there. You have IMSA, which we think came up with some fantastic rules. Just look at the number of manufacturers that have gravitated to IMSA and WEC. It almost feels like an overnight success, and with our McLaren Automotive business, its largest market is North America.

“As we look at what our long-term strategic objectives are, wheels start turning. Working with McLaren Automotive, potentially around a prototype sports car program, suddenly becomes pretty interesting.

“You can see we’re dipping our toe in the water because we’re running a couple of (McLaren 720S) GT3s in the World Endurance Championship and we have a partnership with Pfaff Motorsports in IMSA. That’s not by accident. Let’s just start planting some seeds in those championships, because we’re a big believer of what we’re seeing out of them, and that might be something in a few years’ time that we want to go all-in on.

“Obviously, we have to evaluate how much commercial sponsorship we can raise in any one particular market. With my passion for racing, I’d love to do it all, but business will drive where we go racing, not my personal passion.”

Brett Farmer/Motorsport Images

IndyCar team owner Roger Penske purchased the series and the Indianapolis Motor Speedway at the same time McLaren acquired a majority stake in the former Arrow Schmidt Peterson Motorsports IndyCar operation. Since 2020, Penske has rejected multiple offers to buy the series, which includes at least one inquiry from Formula 1 and MotoGP owner Liberty Media.

If it’s going to prosper under Penske’s command, Brown would like to see changes in the tight financial reins applied to the series.

“Our sport requires more investment that will pay off by delivering real, tangible value to both IndyCar and its teams,” he said. “If you look at what Liberty Media invested in the Las Vegas Grand Prix as an example, I can tell you we have significantly more sponsorship today because of the excitement that Las Vegas created.

“So we think you can look at payback around specific investments in the short term, but also in the long term. Look at the value of what Formula E is worth, what charters in NASCAR are worth, the team value that Formula 1 has created. Williams was sold for $150 million five years ago, and I believe today, their price is around $1.5 billion.

“So in five years, they’ve 10x’d the value of the sport, and that should be the level of expectation we all have in IndyCar. Make our sport 10x in value creation for all the stakeholders over the next five years. That should be the trajectory and ambition we have. A lot of that will require investment — but it will pay back over that period.”

Yahoo Autos

Yahoo Autos