How to Buy or Lease a New Car

Whether it's your first car or you're replacing your old ride, the process of buying or leasing a new vehicle is often a daunting one. Not only is a large purchase stressful, the car-buying process is ripe with opportunities for consumers to make an error in judgment or be taken advantage of by a pushy salesperson. Not to fear! The Car and Driver team is here to arm you with all the information you need to go into this process with confidence—and to come out of it feeling good about the decisions you've made as you're handed the keys to your new car, truck, SUV, or van.

How to Choose a Car That's Right for You

The first step in any car-buying process is deciding what type of vehicle is right for you. SUVs are popular but they come with trade-offs such as lower fuel economy, and they can be more difficult to park than a sedan or hatchback. Electric vehicles are trending and many buyers are considering them as a way to reduce their carbon footprint, but consumers with longer commutes or road-trip aspirations may find driving ranges still aren't long enough to cover such use cases.

To help narrow down your search to a particular body style or vehicle size, start by considering your lifestyle and make a list of things that are important to you. Consider also your budget so you can ensure that the vehicles you're interested in fit within what you can afford. If you're on a limited budget but your lifestyle does require a larger vehicle or an SUV—which tend to carry higher price tags—perhaps a used model would be a better fit. Once you've thought through those things, it's time to start looking at your options. Use the handy stories below to help choose which models to start researching, and then make a list of ones you plan to test drive.

Buying vs. Leasing: How Do I Decide?

There's a lot to consider here. Leasing might net you a smaller monthly payment but your lifestyle may be cramped by a lease's mileage limits. Taking out an auto loan may give you an opportunity to own the car outright after you've paid off the financing, but without the right amount of down payment, you might get some sticker shock when it comes to fitting the payment into your budget.

Consider how you'll use the vehicle and how many miles you expect to put on it annually. Will you be needing it only for short commutes and Sunday errands? Or will it serve as a frequent touring companion for long-distance driving? It's also important to examine your intentions with the vehicle over the long-term. Are you the kind of person who prefers to upgrade every few years or are you fine with the idea of long-term ownership? There are pros and cons to both buying and leasing, but it's important to have a good idea of what's best for your situation before you enter a showroom.

Negotiating and Buying from a Dealership

Like it or not, a car dealership will most likely play a big role in your next new vehicle purchase. Their sales professionals can be valuable partners in completing your task, but it's important to know that their primary job is to make money. Smart negotiators advise knowing what your leverage is and using it to your advantage.

Preparing for working with a dealership means knowing as much as possible ahead of time, including what model you're interested in, what packages are available, and how much a fair price on such a car should be. Be careful not to get too hung up on a monthly payment, because dealers can manipulate a payment easily by extending the terms of a loan or working a larger down payment into the formula. If you're trading in a car, make sure to negotiate your current car's value as a separate conversation to the negotiation on the new car's purchase price. More tips and suggestions can be found in the stories below, but the most important advice we can impart here is that you shouldn't be afraid to walk away if you aren't satisfied with a deal.

Special Order vs. Dealer Inventory

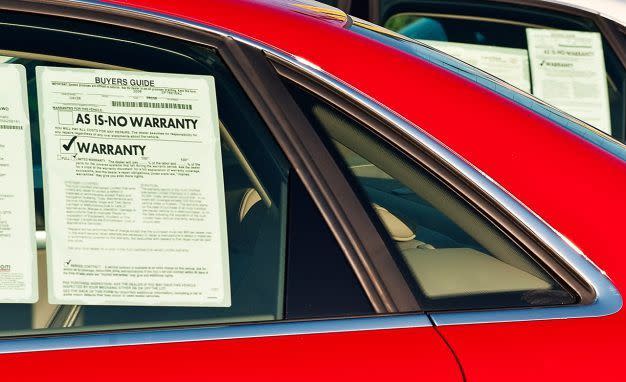

Extended Warranties, Add-ons, and Extras

Okay, you've successfully negotiated a fair deal on your new car and the hard part is over, right? Wrong. The next step will likely be a series of sales pitches from the dealer's finance manager as you complete the paperwork required to finalize the deal. Be prepared to hear about extended warranties, fabric protection, wheel and tire insurance, and a host of other add-ons, some of which may be worth it and some of which may not. Like your analysis in the buying-versus-leasing section, your intention with the vehicle should help you identify if any of these things are necessary. For example, if you plan to drive significantly more miles than average over the first five years of ownership, an extended warranty may be worth the peace of mind after the standard warranty package expires. However, if you're leasing and sticking to a low mileage situation, that same warranty would be overkill. Many of these optional features aren't cheap, so be smart and don't feel obligated to add any of them to your new car deal if they don't seem worth it to you.

You Might Also Like

Yahoo Autos

Yahoo Autos