Could The Shoe Zone plc (LON:SHOE) Ownership Structure Tell Us Something Useful?

If you want to know who really controls Shoe Zone plc (LON:SHOE), then you'll have to look at the makeup of its share registry. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

With a market capitalization of UK£95m, Shoe Zone is a small cap stock, so it might not be well known by many institutional investors. Our analysis of the ownership of the company, below, shows that institutional investors have bought into the company. Let's take a closer look to see what the different types of shareholders can tell us about Shoe Zone.

Check out our latest analysis for Shoe Zone

What Does The Institutional Ownership Tell Us About Shoe Zone?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

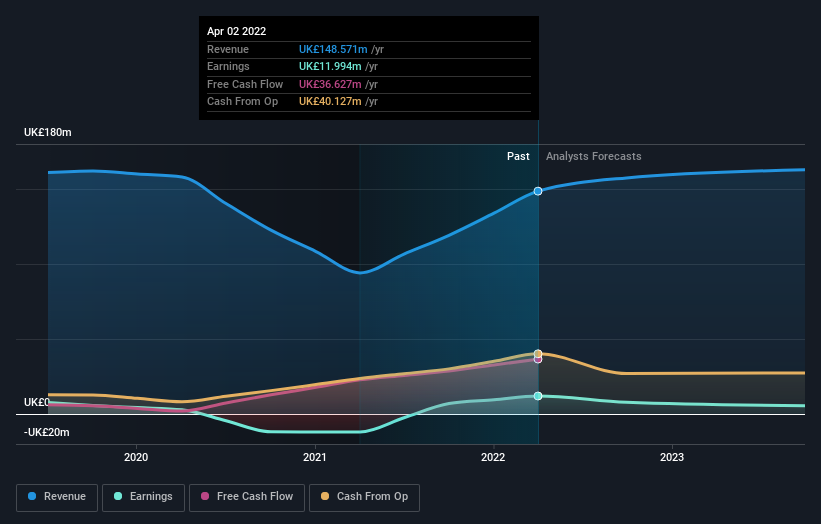

Shoe Zone already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Shoe Zone, (below). Of course, keep in mind that there are other factors to consider, too.

We note that hedge funds don't have a meaningful investment in Shoe Zone. Looking at our data, we can see that the largest shareholder is the CEO Anthony Edward Smith with 30% of shares outstanding. In comparison, the second and third largest shareholders hold about 24% and 12% of the stock. Interestingly, the second-largest shareholder, John Charles Smith is also Chief Operating Officer, again, pointing towards strong insider ownership amongst the company's top shareholders.

After doing some more digging, we found that the top 2 shareholders collectively control more than half of the company's shares, implying that they have considerable power to influence the company's decisions.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

Yahoo Autos

Yahoo Autos