What Is Dealer Invoice Price and How It Can Help (or Hurt) You When Buying a Car

After years of inventory shortages and high prices, the new car market is finally starting to favor the consumers over the dealers. One “trick” to get a better deal that gets mentioned frequently is the idea of fighting for the “invoice price.” Here is a breakdown of what invoice means and why focusing too much on it may work against you.

What Is Car Invoice Pricing?

The invoice price is the dealer cost of the car to purchase from the automaker itself. That is, carmakers sell cars to dealers, and dealers sell cars to you. The invoice price is not a “fake” number, as I have heard some so-called experts claim, but how the invoice relates to what you will actually pay for the car can vary depending on what you are shopping for and where you are shopping for it.

How Big Is the Difference Between Invoice and MSRP?

The difference between the invoice and the Manufacturer Suggested Retail Price (MSRP) is essentially the profit margin for the dealer. That’s the gap between the wholesale cost from the manufacturer to the retail cost (sticker price). Often people think that this gap is wider than it really is. Typically there is a margin of three to eight percent between invoice and MSRP. On your lower-end cars, like a base-model Toyota Corolla, that number will be closer to three or four percent. On a fully loaded Porsche 911 Turbo S, that margin may be closer to 10 percent.

Here is an example dealer sheet from a Subaru store that highlights the invoice and MSRP on a brand-new Forester:

The total MSRP with the destination for this model is $32,385. The dealer paid Subaru $30,831. That’s a margin of $1554 or about 4.8 percent.

This is an invoice sheet for a Ford F-150:

Total MSRP on this truck is $55,820 with a dealer cost of $52,217.52. That’s a margin of $3602, or about 6.5 percent. Now you will notice some other prices that are below that invoice labeled A/Z Plan, D Plan, X Plan, and so on. These prices that result in almost a 10 percent discount are “friends and family” pricing for Ford employees. Buyers need to have a certain “code” to access these discounts.

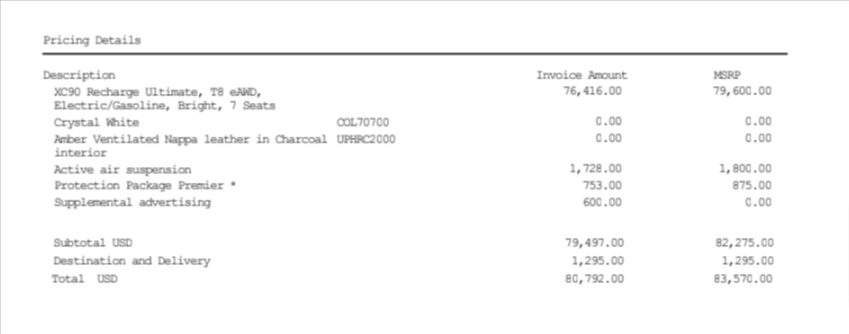

On the higher end of the spectrum, here is an invoice sheet from a Volvo store detailing a fully loaded XC90 T8 Plug-In Hybrid:

Sticker price on this SUV is $83,570 with an invoice cost of $80,792. Despite the high price tag, this car only has a margin of $2778, or about 3.3 percent. In general, electrified vehicles have even tighter margins, and some brands like Ford and Volkswagen have made the invoice and the MSRP identical on their EV models.

Invoice Pricing Is Only One Piece of the Puzzle

There is an old bit of car buying advice that still circulates, where it is recommended to either negotiate down to or up from the invoice price. But knowing what the dealer paid for the car in and of itself may not give you tons of leverage for your deal. Let’s examine two examples of the extremes. If you were in the market for a GR Corolla, you’re looking at an in-demand car with a customer base often willing to pay well over the sticker price. The dealers know this, so a buyer is unlikely to achieve the invoice price and is probably lucky just to avoid the markup. Knowing the invoice alone isn’t a magic bullet. You need more.

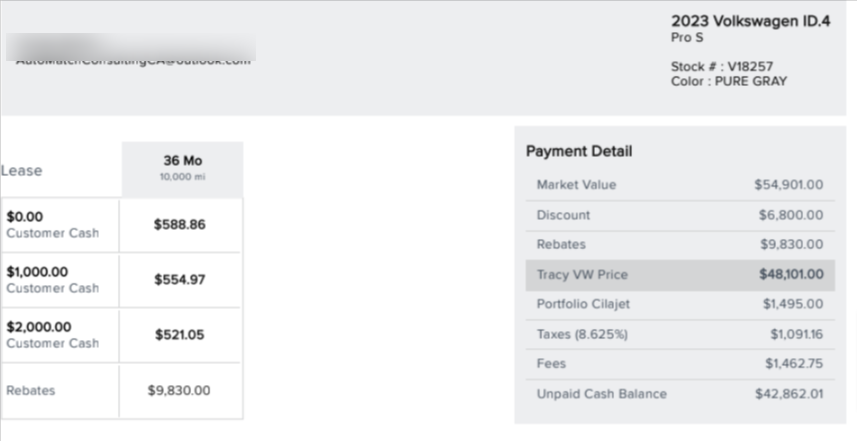

On the flip side, if a buyer is targeting a slow-selling model, getting hung up on achieving the invoice price may leave money on the table. Right now there are some serious deals on electric vehicles, for instance, especially if you lease them. Here is a quote on a 2023 ID.4:

According to VW, there is no gap between the invoice and the MSRP, but what we see here is a dealer discount of $6800. That’s about 12 percent off, in addition to the $9830 in rebates ($7500 Federal Tax Credit on leases included.) This car is being sold for well below that invoice price. This is why a lot of buyers get confused about what invoice really means and why some people say it's not a “real number.” Logically, it doesn’t make any business sense to sell a product at an almost $7000 loss.

Holdback and Dealer Cash Can Go Below Invoice Pricing

Deals like these happen mainly due to two variables that allow dealers to sell below their invoice. The first is holdback and the second is a “hidden” rebate that is usually referred to as “dealer cash.” Holdback is extra money given from the automaker to the dealer to cover things like advertising and floorplan costs. It’s just a little extra wiggle room to make a deal. If a dealer really wants to move a unit, to hit a certain sales goal and therefore get a bonus from the automaker for doing so, then the dealer can dig a little deeper into its holdback. However, the holdback isn’t all that dramatic. It’s typically a few hundred dollars below the invoice.

Dealer cash, on the other hand, works as an unadvertised rebate that is given to the dealer from the automaker to help it move slow-selling cars. Dealer cash can be several hundred to several thousands of dollars, and it can vary from dealer to dealer and region to region. Also, dealers are not obligated to pass on this dealer cash to you if they so choose, though it will likely put them at a competitive disadvantage if they don’t. For example, if a dealer has $3000 in dealer cash on a given model and sells that car at the invoice price, they can pocket that factory money. Of course, if its competitor across town offers that dealer cash in addition to the discount to invoice price, it is more likely to score more customers.

Understanding the invoice price is a good benchmark for knowing whether or not a deal seems competitive, but it’s just one piece of the puzzle. To really understand whether or not you are getting a competitive price, you need to compare your quotes and keep in mind that the best deal is relative to the market conditions for that car. Therefore, the invoice isn’t nearly as important as comparing the total cost of the purchase across multiple dealers for the same car.

Tom McParland is a contributing writer for Road & Track and runs AutomatchConsulting.com. He takes the hassle out of buying or leasing a car. Got a car buying question? Send it to Tom@AutomatchConsulting.com

You Might Also Like

Yahoo Autos

Yahoo Autos