DiamondRock Hospitality Company's (NYSE:DRH) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

DiamondRock Hospitality's (NYSE:DRH) stock is up by a considerable 12% over the past month. However, we decided to pay attention to the company's fundamentals which don't appear to give a clear sign about the company's financial health. In this article, we decided to focus on DiamondRock Hospitality's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for DiamondRock Hospitality

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for DiamondRock Hospitality is:

3.7% = US$58m ÷ US$1.6b (Based on the trailing twelve months to June 2022).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each $1 of shareholders' capital it has, the company made $0.04 in profit.

What Is The Relationship Between ROE And Earnings Growth?

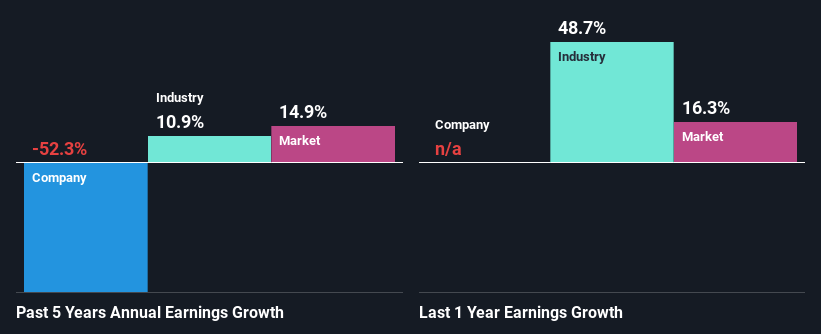

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Yahoo Autos

Yahoo Autos