Drone Delivery Canada (CVE:FLT) Is In A Good Position To Deliver On Growth Plans

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for Drone Delivery Canada (CVE:FLT) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Drone Delivery Canada

When Might Drone Delivery Canada Run Out Of Money?

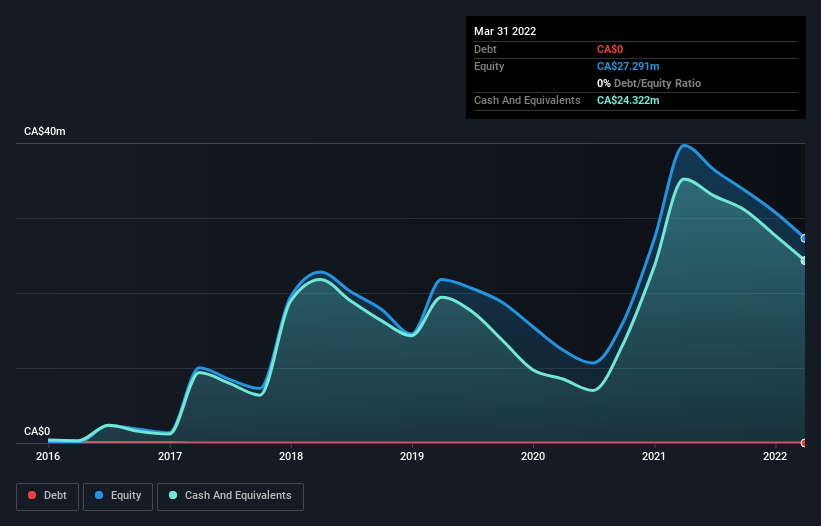

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at March 2022, Drone Delivery Canada had cash of CA$24m and no debt. Looking at the last year, the company burnt through CA$11m. Therefore, from March 2022 it had 2.2 years of cash runway. That's decent, giving the company a couple years to develop its business. The image below shows how its cash balance has been changing over the last few years.

Yahoo Autos

Yahoo Autos