Elon Musk's biggest booster says it might be 'time to sleep on the floor' at Tesla

Elon Musk might need to start sleeping at Tesla again as tough times mount, according to top bull Adam Jonas of Morgan Stanley.

The firm may slowly be exiting the EV industry, given rising Chinese competition and dimming outlooks, he said.

Jonas holds a Street-high $310 price target on the firm, but says Musk's compensation deal is also adding uncertainty.

It might be time for Elon Musk to bring back an old corporate habit to reignite Tesla's spark, according to Morgan Stanley analyst Adam Jonas.

"Looking ahead to Tesla's 1Q results ... investors are starting to ask: 'Is it time to sleep on the floor again?'" Jonas said in a note published on April 18.

The reference is to when the CEO would spend nights doing so over past years, in an effort to encourage hard work during tough times.

Just a year ago, this would be an unlikely comment from the long-standing Tesla bull. But now, tougher times might indeed be back, as Jonas acknowledged that an electric vehicle recession has engulfed the leading manufacturer.

With conditions deteriorating and competition rising, it may even be that Tesla is starting to eye an exit from the traditional EV-maker industry. Such a shift has been signaled by the company's recent decision to scrap plans for a low-cost Model 2, and instead focus on autonomous driving and robotaxis. Wall Street didn't love the move, sending the stock even lower to fresh year-to-date lows this past week.

"Is Tesla exiting the (traditional) EV auto industry? At the margin, it seems so. This doesn't mean that Tesla won't keep selling cars (including new launches) for many years to come. But this cannot be the end game," Jonas wrote, adding that Tesla's 50% targeted annual growth rate is no longer valid.

Generally, challenges are penetrating the EV market from all sides, whether they be infrastructure, vehicle affordability and repairability, or rising competition from hybrids. It's not only a domestic issue for Tesla, as cheaper Chinese alternatives are cutting deep into crucial offshore demand.

Most recently, this has snapped Tesla's first quarter deliveries — where these increased 40% last year, they plummeted 10% year-to-year in 2024's opening months.

With more industry players popping up, the firm has taken to slashing its pricing, and Musk has hinted for years about a model that would cost under $30,000. Tesla is in fact planning a mass-market vehicle to start producing next year: the ramp up will require workers to sleep at the factory, Musk warned in the last earnings call.

But even if the company succeeds to create a appealing and affordable model, Jonas is skeptical that this is a winning strategy to the Chinese threat:

"How long would it take for a Chinese EV company to make one like it at a lower price? 9 months? 3 months? Less? New models are important for Tesla and we expect half a dozen or so different 'shapes' and form factors launched in the years ahead," he said. "But perhaps Tesla has already learned what most autos analysts have long known about the car industry."

Nor should investors bet solely on Tesla's ambitions in automotive driving. Though other analysts have touted full self-driving technology as a stock price headwind, Jonas sees commercialization at scale of these developments as far out.

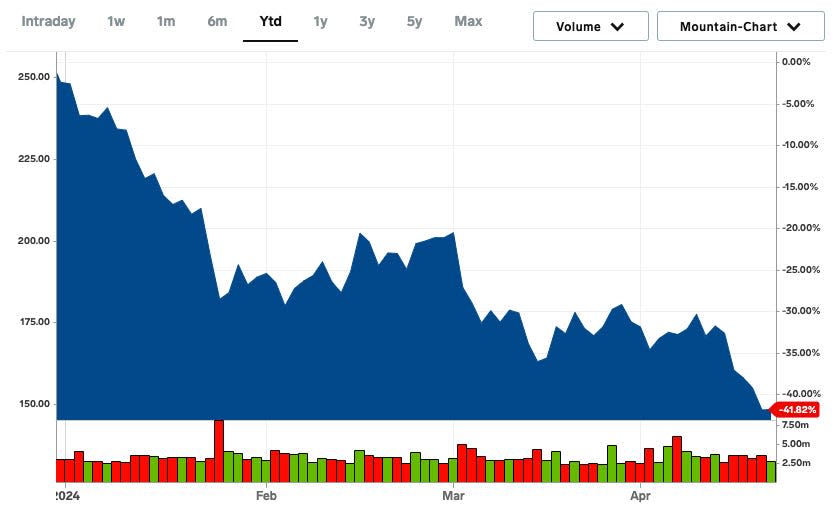

Market challenges have already tanked Tesla's stock over 41% year-to-date. Consensus expectations need to stabilize before it can begin to outperform again, Jonas said.

He continues to hold an overweight on Tesla, with a price target of $310. However, aside from earnings strength, the stock's success also hinges on Musk's compensation package, Jonas added.

That's as the CEO has previously threatened to move AI capabilities away from Tesla if he is not given a 25% stake in the company, adding existential uncertainty for investors, the analyst said.

Read the original article on Business Insider

Yahoo Autos

Yahoo Autos