Ford’s F-150 Lightning means tough choices for buyers seeking EV tax credits

Americans love a Ford pickup truck; it’s one of the few constants of the car business. So it was a huge win on Tuesday when Ford’s F-150 Lightning became one of just 10 vehicles to qualify for the full $7,500 in tax breaks laid out by the US Inflation Reduction Act. Dozens of other electric cars and trucks didn't make the cut, either because they aren’t manufactured in the US or don’t use American parts and pieces.

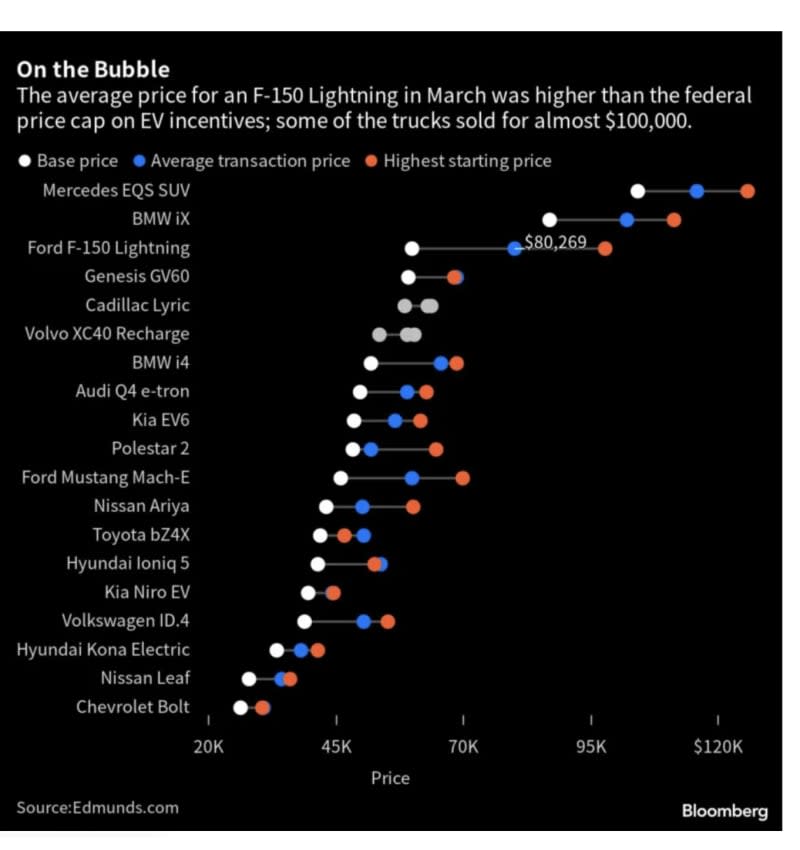

The tax credits also only apply to new EVs with a sticker price below $55,000, or trucks and SUVs priced under $80,000. And that’s where Americans’ truck lust is butting up against their taste for high-end trims. While the average gasoline-powered F-150 now sells for almost $63,000 — 25% more than five years ago — the electric version commands a premium of almost 30% over that, selling for $80,300 on average last month, according to Edmunds. That means roughly half of Ford’s electric pickups are too fancy for federal incentives.

“Honestly, I’m not even sure you can order the lower-end models at the moment,” said Zach Westrum, owner of Granger Motors, a Ford dealership near Des Moines, Iowa. “We’re about to find out very soon if these are just a second car for an affluent person or can become a primary car for a regular person.”

Yahoo Autos

Yahoo Autos