Introducing Elsight (ASX:ELS), A Stock That Climbed 75% In The Last Year

The Elsight Limited (ASX:ELS) share price has had a bad week, falling 11%. But looking back over the last year, the returns have actually been rather pleasing! In that time we've seen the stock easily surpass the market return, with a gain of 75%.

View our latest analysis for Elsight

Elsight wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Elsight grew its revenue by 34% last year. That's a fairly respectable growth rate. While the share price performed well, gaining 75% over twelve months, you could argue the revenue growth warranted it. If the company can maintain the revenue growth, the share price could go higher still. But it's crucial to check profitability and cash flow before forming a view on the future.

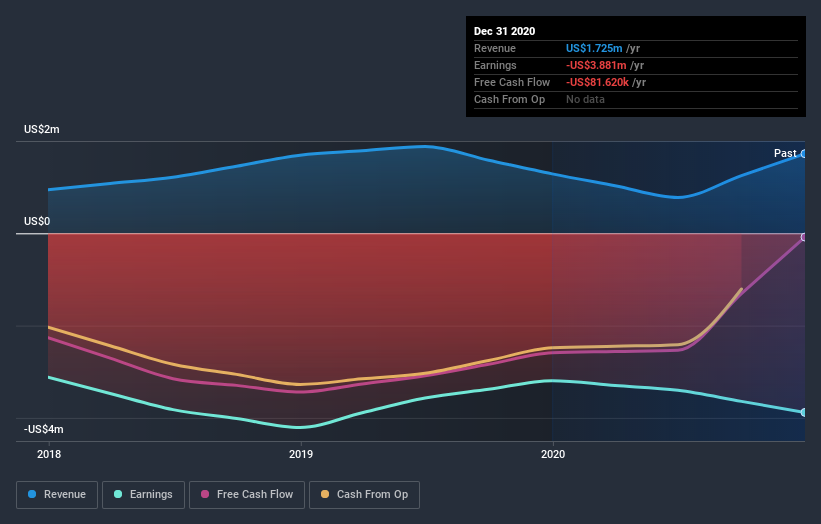

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Elsight's financial health with this free report on its balance sheet.

Yahoo Autos

Yahoo Autos