LexxPluss expands into US with its warehouse robots

When Masaya Aso worked on autonomous driving technology at Bosch in Japan and Germany, he realized that "many tasks were still manual as over 85% of warehouses have almost no automation at all."

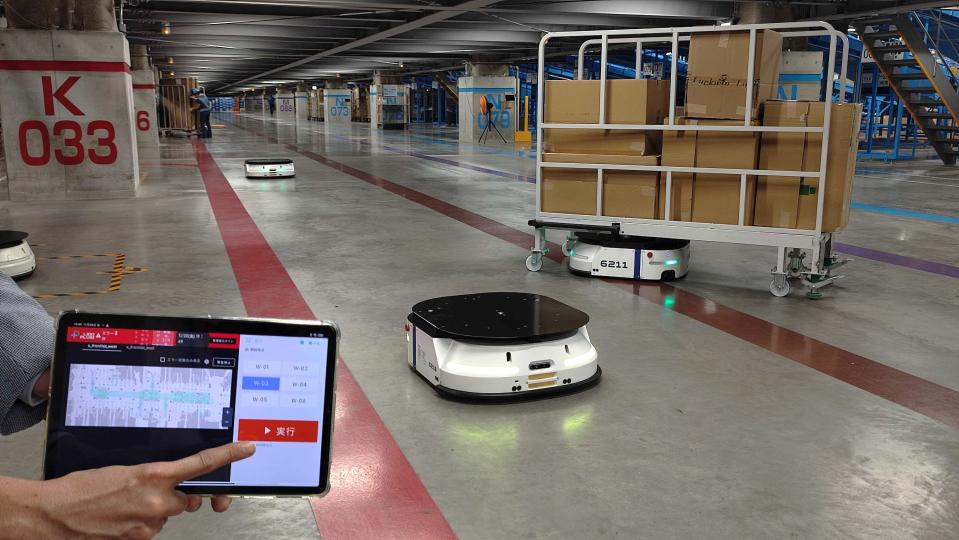

To help address the problem, Aso co-founded LexxPluss, a now two-year-old, Japan-based startup that designs and develop autonomous mobile robots to transport loads and optimize workflows within warehouses and logistic sites.

Aso, who is CEO of the outfit, co-founded it with robotics and autonomous vehicle veterans from Bosch, Amazon, Honda and more, and now the Japanese outfit is preparing to enter the U.S. with a fresh injection of about $10.7 million (1.45 billion JPY) of Series A funding that values the company at approximately $38.8 million (5.26 billion yen).

Drone Fund led the latest financing along with SOSV's HAX, Incubate Fund, SBI investment and DBJ Capital.

LexxPlus initially targeted the logistics and automotive manufacturing spaces because those spaces are actively deploying robots beyond their production lines. Its main customers are in Japan in the logistics and automotive sectors; some of the current automotive components makers have facilities in the U.S., Aso said. It wants to use its existing clients' relationships to enter the U.S. market, the largest autonomous mobile robots market, which was already $762 million in 2021 and is expected to grow to $3.2 billion by 2028, accounting for about 40% of the global market size.

In addition to the U.S. expansion, said Aso, the Series A money will help the company's product development, increasing its payload to 500kg (a high-demand feature from e-commerce players), and adding a 3D visualization of a "digital twin" of operations for remote control and monitoring.

In terms of its competition, OTTO Motors, OMRON and Locus Robotics have also built autonomous mobile robots. Aso said LexxPluss' differentiation centers on larger payloads (up to 500kg) and more open mechanical design intellectual property (IP) and application programming interfaces (APIs) that make maintenance and integration easier for customers. He adds that some of the company's rivals tend to have closed IP, which is a pain point for their customers.

"Since we disclose lots of technical information, our partners can take a look into every detail of our technology," Aso explained. "So they can understand how it works and how it can be deployed and used in their warehouse or factories. They can even [handle] maintenance by themselves. Our approach is to maximize product transparency and make collaboration much easier."

The startup launched its sale strategy last year and now has seven clients and 32 partners, which are part of an open industrial robotic program that it launched last June. "The program is to accelerate collaboration with industrial robotics companies by disclosing most of our technical information, such as 3D CAD design, Electrical Design, embedded software, manufacturing process documents, deployment tools, maintenance documents, APIs, and so on," Aso told TechCrunch.

The startup currently generates sales via a monthly subscription model or half upfront and half monthly subscription fee, Aso noted.

Naturally, the company's investors think the company has a good shot at nabbing a meaningful slice of a big market. Recent research forecasts that the autonomous mobile robots market is projected to reach $8.70 billion by 2028, up from $1.97 billion in 2021.

"LexxPluss has a significant advantage over other warehouse automation companies as they leverage a large technical team in Japan, renowned for both industrial robotics (37% of the global market) and the automotive sector (35% of the U.S. automotive industry)," said Duncan Turner, general partner at SOSV and managing director of HAX.

"Their technical strength, combined with insight from decades of industry experience, will help them crack the U.S. market where seamless integration is key."

Yahoo Autos

Yahoo Autos