Oil Company Building First Large-Scale Carbon Capture Plant in Order to Keep Drilling

Occidental Petroleum Corp., one of the most productive oil and gas producers in the U.S., wants to keep producing that gas and oil even in the wake of a de-carbonizing world. To do that, Occidental is using a Hail Mary play: a massive carbon capture plant deep in the heart of Texas.

In case you missed it:

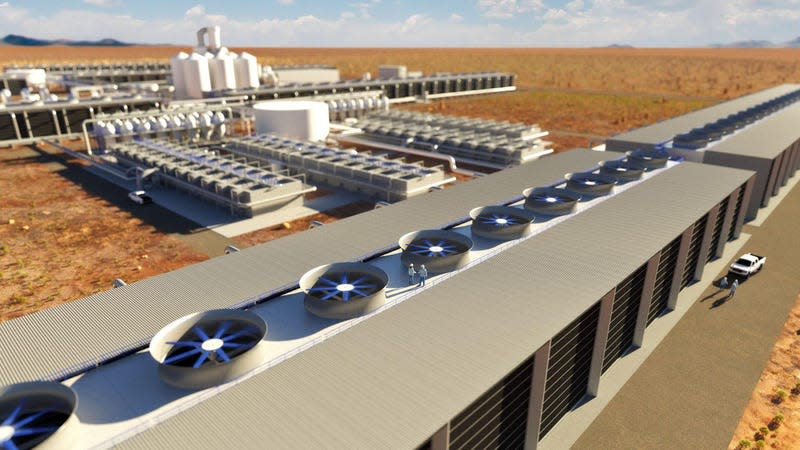

The plant in Midland, Texas, will be the first of its kind and scale in the world when its opens in 2024 (though a European company called Climeworks has 18 facilities performing test operations.) The process is simple: large fans will suck in air, scrub out the carbon, press the greenhouse gas down into pellets and either store those pellets underground or turn it into synthetic fuel and materials.

Read more

Occidental estimates one plant can cure the carbon output of one year’s worth of driving from 110,000 cars. But that’s not all: Occidental plans to produce “net-zero” oil and sell that oil at a premium, as well as selling carbon credits to industries not able to quickly switch to electric, like air travel.

Critics of the carbon capture approach to cooling down the planet say such plants will only prolong our reliance on carbon fuels. To which Occidental Petroleum says, uh, yeah, that’s kind of the point. From the Wall Street Journal:

Chief Executive Vicki Hollub, who has the blessing of the company’s largest investor, Warren Buffett, said the plan will help it reach net-zero emissions on all its operations, its own energy use and its customers’ use of its products, by 2050, and allow it to keep investing in oil extraction.

Ms. Hollub told investors last year she also expects the clean-energy efforts to eventually become more lucrative than the company’s chemical segment, which manufactures basic chemicals and petroleum-derived products such as vinyls, and is the next-biggest revenue generator after oil and gas. OxyChem’s revenue was $6.7 billion in 2022, roughly 19% of Occidental’s revenue that year, according to the company.

Removing CO2 from the atmosphere at this scale has never been done before, and the enterprise comes with abundant commercial and scientific uncertainties. It is unclear what the appetite for carbon removal will be, how much the service will eventually cost or how massive volumes of buried carbon dioxide will affect the subsurface in the long term.

The thing about carbon capture is that, so far, these plants tend to need a lot of energy, burning more fossil fuels than they capture. Shell Oil’s carbon capture cost Canadian taxpayers $654 million and still ended up producing more pollution than it sucked out of the air. To avoid this issue, Occidental Petroleum is running its plant in a very bright and sunny region of Texas, relying on renewables from the grid as well as their own solar. There were even discussions of running the fans on small nuclear reactors, WSJ reports.

The technology, especially at this scale, is still unproven, as is the market for the other revenue streams the company expects from the plant. A recent report from Science, however, indicates the estimated costs of capturing carbon are quickly dropping thanks to advances in the technology over the last decade. Instead of $600 per ton of carbon just in 2011 to just $100 a ton today. Occidental plans to build 135 such plants by 2035 and already has land leased in Texas and Louisiana.

More from Jalopnik

Sign up for Jalopnik's Newsletter. For the latest news, Facebook, Twitter and Instagram.

Yahoo Autos

Yahoo Autos