Rally Rd. Collector-Car App Lets Anybody Own Shares in a Dream Vehicle

Are you interested in investing, but find tracking your 401k about as soul-stirring as enjoying a glass of warm milk while compiling the ultimate Kenny G playlist? Consider reading the fine print on a certificate of deposit prospectus a one-way ticket to Yawnsville? Then we suggest you check out Rally Rd., an app that allows enthusiasts to invest in rare, collectible-grade classic cars for as little as $40 per share. Sound complicated? It's not.

Basically, it works like this: You download the Rally Rd. app, currently available only for iOS devices, provide enough information to verify your identity and establish your source of funds (note, since it's a stock-purchasing app, you must provide your Social Security number before you can access all of the features), then scroll through the current collection of cars by swiping, Tinder style. Before you know it you're a part owner of the car, er, uh, investment of your dreams.

App Seeks Best-in-Class Investment Cars

To select the cars that make up its roster, the Rally Rd. app explains, it takes into consideration the potential investment's rarity, significance, history, originality, value, condition, and additional data-driven factors. Naturally, the app's creators look for best-in-class vehicles and investigate whether they have been properly maintained or restored. There is no timeshare provision for wheel time in any car you add to your portfolio, sadly, although there are plans for a program to let investors drive "similar" cars.

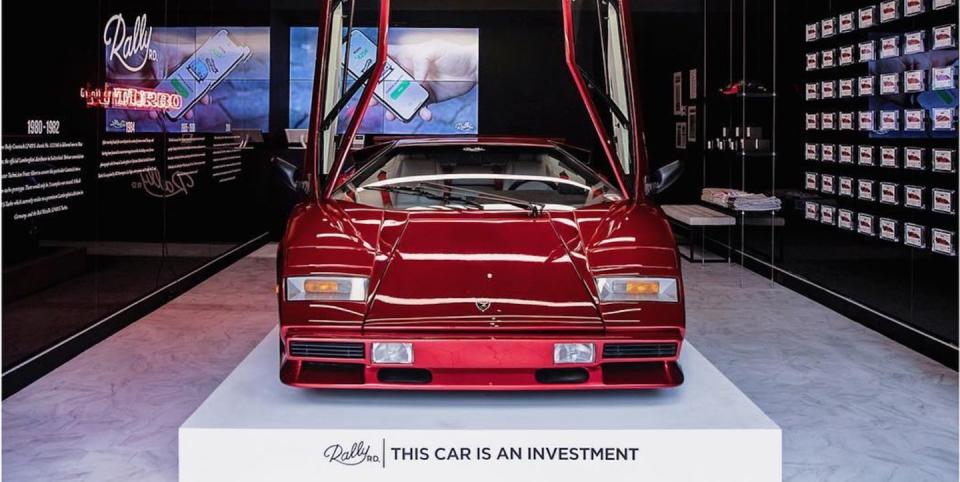

To lend a more human element to the proceedings, co-founders Rob Petrozzo, Christopher Bruno, and Max Niederste-Ostholt opened a 1500-square-foot storefront at 250 Lafayette Street in Manhattan's fashionable SoHo neighborhood last weekend. The showroom is designed as an attention-getting outpost only, since many of the vehicles are stored in a climate-controlled secured warehouse at an undisclosed location. Rally Rd. says the showroom will be open to the public on Saturdays, and a small amount of merchandise including clothing is available for sale there. This may play into the company's larger goal of providing premium access to IPOs of super-rare cars and extended trading opportunities, potentially including buying the car outright.

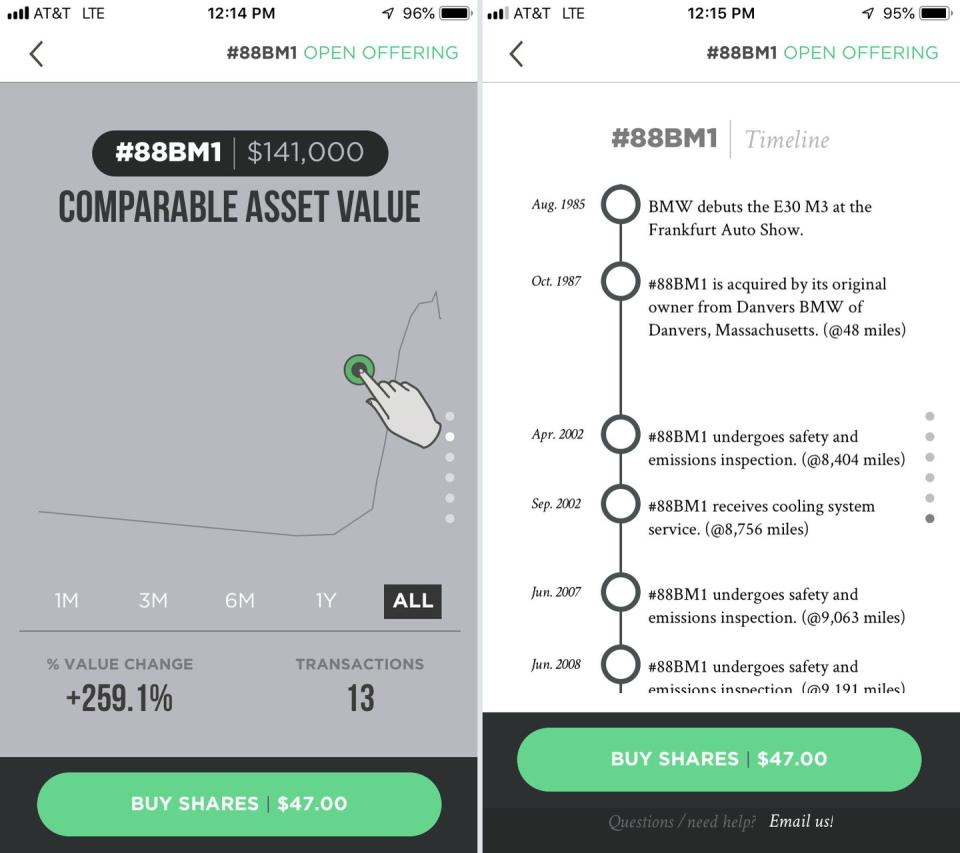

To investigate the app's functionality, we completed a Rally Rd. registration, which took just minutes. The first car offered in the queue was a 1988 BMW M3 that is currently valued at $141,000. Listed as an initial offering, shares are offered at $47; currently 55 percent funded by 348 investors, the offering closes on February 11. Additional details are accessed by swiping up, which reveals a comparable-asset chart, comprehensive imagery, and a detailed timeline of the specific car. At that point, buying in is just a click away.

Additional vehicles at the top of the queue included a 1980 Lamborghini Countach valued at $635,000, currently priced at $127 per share; this offering had reached the full valuation, so the buy-in is closed. An additional dozen or so high-profile vehicles were also listed. Investments of this type are generally referred to as alternative assets; like art or wine, they can be more volatile than traditional low-risk CDs or bonds. While Rally Rd. is not the first initiative to trade in vehicular alternative assets-the Classic Car Fund operates similarly-it's certainly the first aimed directly at the affluent under-40 crowd.

Rally Rd. points out that vintage autos as a category returned 288 percent in the past decade, more than twice the S&P 500. Its securities are regulated by the U.S. Securities and Exchange Commission and offered for sale through a registered broker-dealer and member of FINRA and SIPC that is licensed in 32 U.S. states (they intend to add more, the company says). There are no commissions or management fees, and to ensure it also has some skin in the game, the company itself takes a position in each vehicle (up to 10 percent of the shares) at the same price and class of shares as the individual investors.

That said, it's important to remember that, as with any investment, you are simply buying shares in something that you are speculating will increase in value before you sell. Should Rally Rd. need to liquidate, proceeds will be paid to shareholders in the same manner as a company sale in a typical stock exchange. Risk is very real, values will fluctuate, and should you decide to sell, Rally Rd. does not guarantee a buyer for your share(s).

Even so, a big selling point is surely that talking about and researching collector cars is infinitely more enjoyable and interesting for a large swath of the population than poring over IBM's portfolio. Should you lose your proverbial ass, retelling the story of losing money on a sweet Lambo deal is a helluva lot more entertaining to the person on the next barstool than relating the harrowing market ride that was the great vanilla-wafer crash of 1999.

('You Might Also Like',)

Yahoo Autos

Yahoo Autos