Shareholders in 4D Molecular Therapeutics (NASDAQ:FDMT) have lost 77%, as stock drops 12% this past week

While it may not be enough for some shareholders, we think it is good to see the 4D Molecular Therapeutics, Inc. (NASDAQ:FDMT) share price up 15% in a single quarter. But that hardly compensates for the shocking decline over the last twelve months. Indeed, the share price is down a whopping 77% in the last year. It's not uncommon to see a bounce after a drop like that. The real question is whether the company can turn around its fortunes.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for 4D Molecular Therapeutics

4D Molecular Therapeutics recorded just US$2,840,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, they may be hoping that 4D Molecular Therapeutics comes up with a great new product, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. 4D Molecular Therapeutics has already given some investors a taste of the bitter losses that high risk investing can cause.

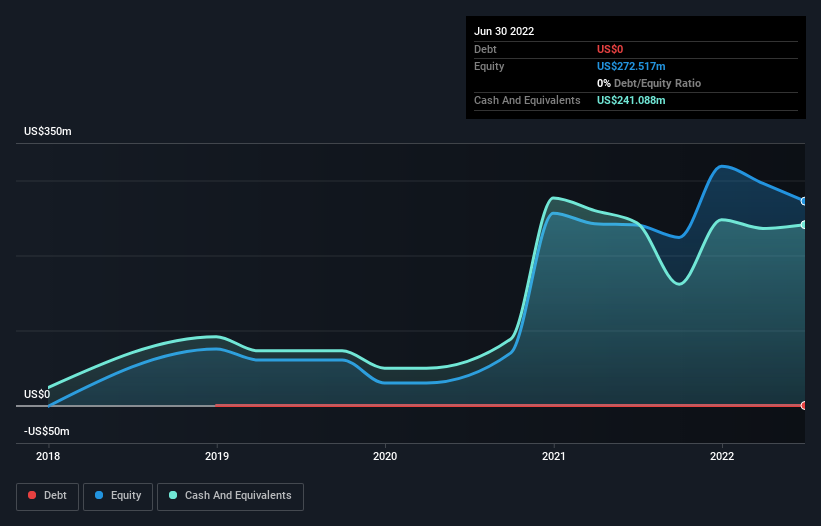

4D Molecular Therapeutics had cash in excess of all liabilities of US$211m when it last reported (June 2022). That's not too bad but management may have to think about raising capital or taking on debt, unless the company is close to breaking even. With the share price down 77% in the last year , it seems likely that the need for cash is weighing on investors' minds. You can see in the image below, how 4D Molecular Therapeutics' cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. What if insiders are ditching the stock hand over fist? I would feel more nervous about the company if that were so. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

We doubt 4D Molecular Therapeutics shareholders are happy with the loss of 77% over twelve months. That falls short of the market, which lost 20%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's great to see a nice little 15% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that 4D Molecular Therapeutics is showing 5 warning signs in our investment analysis , and 1 of those is significant...

But note: 4D Molecular Therapeutics may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Autos

Yahoo Autos