Should Taunton schools spend millions to save millions on lucrative solar deal?

TAUNTON — Should Taunton Public Schools invest in solar power?

It’s certainly a big, lucrative, and feasible venture, the city's Chief Financial Officer Patrick Dello Russo told the Taunton School Committee.

At the Committee’s March 15 meeting, Dello Russo brought along the solar consultant for the city, Matthew Parent of Summit Solar, who previously consulted on the proposal to put solar arrays on Taunton’s Landfill.

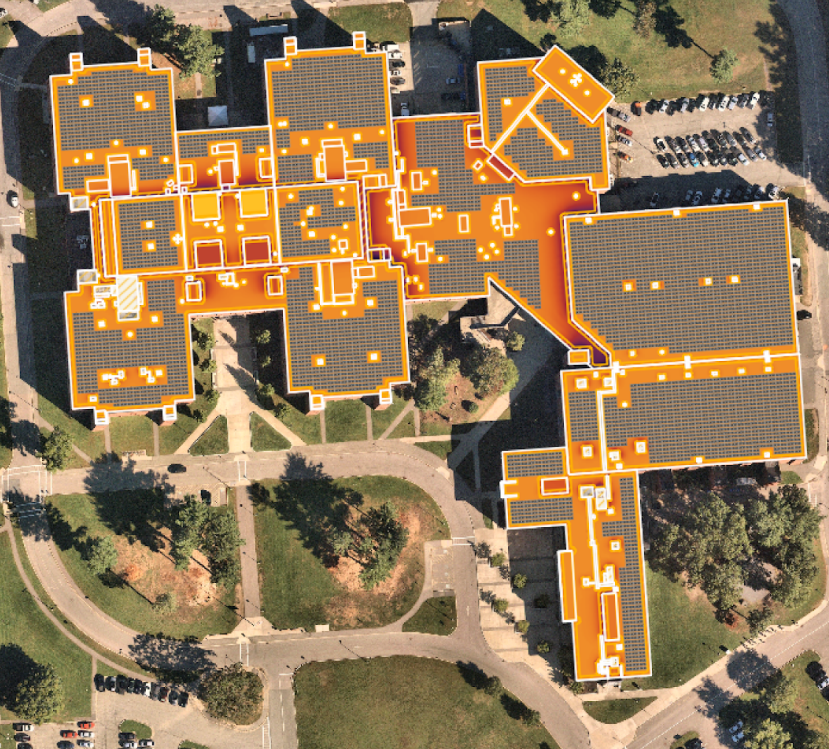

Parent conducted early-stage site assessments of all 12 schools’ rooftops and provided a best-case scenario where spaces on the roofs are maximized to hold the highest number of panels.

How does this differ from the landfill solar array?

What Dello Russo and Parent are proposing is different from what’s going onto the landfill.

With the landfill, the city and TMLP are entering into a power purchase agreement (PPA), where the solar developer will lease the land from the city, build the site themselves, and be responsible for its maintenance. Under this PPA, the developer would sell the energy accumulated back to Taunton at a reduced rate, as well as pay the annual lease fees for the site, over the course of a 20-25 year agreement.

With the school district, what’s being proposed is an outright purchase of solar arrays, with the intention of generating electricity to power the schools and lower utility bills.

Pay hike controversy When did Taunton school board discuss 100% raises tucked away in budget line item?

Parent said that, ideally, with these rooftop solar arrays, power generated during the day will be more than the schools will use. This extra energy will go back onto the energy grid, where TMLP will issue credits for the schools. The credits offset utilities bills, which can be especially beneficial during winter months when the arrays aren’t producing as much energy due to lack of sun.

Parent said each rooftop installation would be eligible for a federal tax credit of 30% of the cost of the array. The school district would have to pay all the installation costs up front, and the 30% tax credit would be reimbursed the fiscal year after completion of the installation.

In addition, each installation also qualifies for renewable energy certificates (RECs), which can then be sold to businesses on the open market. Whoever ends up with the RECs gets "green" credits for using or producing renewable energy.

Yahoo Autos

Yahoo Autos