Tesla's Price Cuts Have Riled Its Newest Customers

If you’re new to the Tesla family there’s a good chance you’re angry, General Motors capped last year strong and Mazda wants you to know that the Miata will be with us until the end of time, as true love always is. All that and more in The Morning Shift for January 31, 2023.

1st Gear: New Tesla Owners Aren’t Happy

Recently I saw a man haggling with a butcher at my local farmers’ market (shout out Q-Mart) over a cut of beef. As the man walked away, both arms in the air, the butcher yelled “it’s gonna cost the same tomorrow, buddy.” That’s pretty much always the way it goes. But if you pulled the trigger on a new Tesla on, say, January 12, and almost put off signing the papers (or PDFs, I’ve never bought a Tesla) for another day, you unknowingly forfeited a chance to save up to 20 percent on your EV purchase. That has to be the one of the worst feelings in the world — even worse than overpaying for ribeye.

Read more

The Wall Street Journal spoke to new Tesla owners about it in a story published Tuesday, and the reactions are predictable.

Vikas Khanna, a 48-year-old healthcare executive, paid around $65,000, excluding sales tax, in late December for a Model Y SUV, which included a $7,500 discount offered by Tesla at the time. The price cut would have saved him about $5,000, taking into account fees and upgrades, according to a review of his purchase order.

“It just reminded me and solidified why Tesla, as an organization, is one that I can no longer trust,” said Mr. Khanna, who had bought two Teslas over the years before his recent purchase.

Mr. Khanna said he understands that companies have the leeway to adjust pricing, but he sees a distinction between fluctuations on a car price and other goods, such as mobile phones.

“You don’t take out a loan for an iPhone,” he said.

Customers in China can relate. Tesla adjusted prices in a similar fashion there just before the new year, leading to protests at the company’s delivery centers. The fluctuations have tanked resale values here as well, to the point where vehicles built within the last three years are depreciating at double the industry average rate, per Edmunds data cited in the article.

Petitions have cropped up with thousands of signatures, in the desperate hope that the company will extend discounts or freebies to those who purchased just before the new pricing took effect. Unfortunately for these customers, it’s not looking like Tesla is about to budge.

Kapil Sharma, an industrial consultant who lives outside of Atlanta, asked his Tesla service center about the possibility of a refund after the company slashed prices. He had taken delivery of a new Model Y, his first Tesla, two weeks earlier.

“We do not have a return policy and we do not price match or price adjust completed orders,” the company told him in a text message exchange reviewed by The Wall Street Journal.

Imagine buying a Tesla and then being mad.

2nd Gear: GM Had a Swell Fourth Quarter

General Motors’ results for the final quarter of 2022 are in. The automaker finished the calendar strong, with net income rising 15 percent in addition to a record pretax profit. From Automotive News:

In the fourth quarter, revenue surged 28 percent to $43.1 billion. Adjusted earnings before interest and taxes in the quarter rose 34 percent to $3.8 billion.

GM said its full-year EBIT of $14.5 billion, up 1.3 percent, was a company record. Its net income for all of 2022 slipped 0.8 percent to $9.9 billion as revenue rose 23 percent to $156.7 billion.

GM’s fourth-quarter adjusted profit in North America soared 69 percent to $3.7 billion.

Shares in GM rose 5 percent to $38.09 in premarket trading.

“GM led the U.S. industry in total sales and delivered the largest year-over-year increase in market share of any OEM, thanks to strong demand for our products and improved supply chain conditions,” CEO Mary Barra said in a letter to shareholders. “We expect that our momentum will help us deliver strong results once again in 2023.”

Though it doesn’t necessarily have much to do with overall sales, 2023 figures to be a big year for GM in one sense: EVs. Battery-powered versions of the Equinox, Blazer, and Silverado work truck will place the missing pieces in the manufacturer’s electric lineup.

3rd Gear: Also, A Lithium Mine

GM is also putting its stamp on Nevada’s Thacker Pass mine, via a $650 million investment that will begin later this year. From the Financial Times:

The US automaker will make an initial investment of $320mn by mid-2023 with a further $330mn to follow later on in return for exclusive rights to the lithium produced at Thacker Pass in the US state of Nevada.

Lithium Americas’s Thacker Pass mine is expected to begin production in the second half of 2026 and will generate enough of the silvery-white metal for up to 1mn EVs a year.

Despite being among the most lithium-rich countries in the world, the US has only one operational lithium mine, which is also located in Nevada. Thacker Pass has been opposed by conservation groups, and a court ruling could decide its fate within months.

Under the agreement, GM would receive exclusive access to the first phase of production at the site, the only operational lithium mine in the country. The automaker has already started producing batteries in Ohio with LG via its Ultium Cells joint venture, and plans to raise facilities in Tennessee and Michigan as well. A fourth Ultium Cell factory was being discussed, though GM and LG have shelved those plans for the time being. GM may choose a different partner for that factory in the end.

4th Gear: The Miata Is Forever

Few things are certain in this world, but Mazda wants us to believe the Miata is one of them. It’ll “never die,” according to the CEO of the brand’s European arm, Martijn ten Brink, per Autocar.

“How do you stay true to the concept of what the car stands for taking it into the next generation of technologies?” he said, when asked about plans for the next MX-5. “That’s not been decided. But I think for Mazda it would be fair to say that the MX-5 will never die.

“I think it will continue to exist forever and it will have to go with the times. That’s a super challenge, and people are passionate about this car in Mazda.

“Of course, as you can imagine, people have opinions on which direction it should go. So I’m very curious where it will end up, but it will definitely remain part of the line-up.”

Of course, Miata fans will note that there have been rumors about the next generation of the beloved convertible being electrified for a long while now. While it’s likely too soon for a full EV that remains in keeping with the Miata’s featherweight ethos, a mild hybrid could deliver the best of both worlds. However it pans out, it’s just nice to know the Miata will always be in our lives in one form or another.

5th Gear: Good for Nissan

Shares of the Japanese automaker saw a slight lift on Tuesday in Tokyo after the company announced a revised agreement with its longtime alliance partner Renault. Via Reuters:

Nissan shares climbed as much as 3.1% in early trade before giving up some gains. They finished the morning session up 2.1%, outperforming a slightly negative Nikkei 225 share average.

Under the deal announced on Monday, Nissan and Renault will now hold 15% stakes in each other, and Nissan will get voting rights with its stake. Previously, Renault held around 43% of the Japanese automaker and Nissan did not have voting rights.

The uneven nature of the alliance had long been a source of friction for Nissan executives.

“The normalisation of the capital relationship will raise the amount of freedom Nissan has in terms of management, making it easier to adopt a strategy that focuses on the United States, China and emerging markets,” Masayuki Kubota, chief strategist at Rakuten Securities, told Reuters following Monday’s announcement.

Nissan as a party with agency, as an active participant in its own destiny? Yeah, I can understand why that might make the company more attractive to investors.

Reverse: To the Moon

On this day 52 years ago...

Apollo 14 departs for the moon

Neutral: The Miatas That Never Were

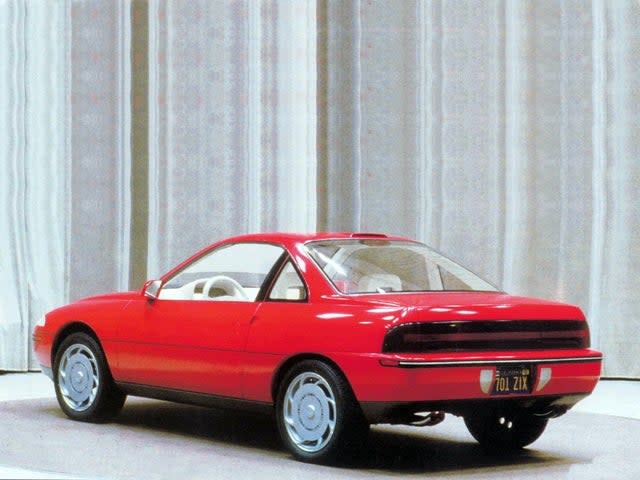

Looking at the back of these first-generation Miata prototypes designed by Yoichi Sato and Hideki Suzuki, it’s weird to imagine a world in which the world’s favorite tiny convertible looked like an Allante or Reatta. The Reatta was a looker for sure, but I’ll take the NA we got, thanks. Fun fact: the top one would’ve been mid-engined, while the bottom was intended to be front-wheel drive, according to Barchetta.co.

More from Jalopnik

Sign up for Jalopnik's Newsletter. For the latest news, Facebook, Twitter and Instagram.

Yahoo Autos

Yahoo Autos