Why Snowflake Inc. (NYSE:SNOW) Could Be Worth Watching

Snowflake Inc. (NYSE:SNOW) led the NYSE gainers with a relatively large price hike in the past couple of weeks. With many analysts covering the large-cap stock, we may expect any price-sensitive announcements have already been factored into the stock’s share price. However, what if the stock is still a bargain? Today I will analyse the most recent data on Snowflake’s outlook and valuation to see if the opportunity still exists.

Check out our latest analysis for Snowflake

Is Snowflake Still Cheap?

Good news, investors! Snowflake is still a bargain right now. According to my valuation, the intrinsic value for the stock is $301.48, but it is currently trading at US$183 on the share market, meaning that there is still an opportunity to buy now. However, given that Snowflake’s share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us another chance to buy in the future. This is based on its high beta, which is a good indicator for share price volatility.

Can we expect growth from Snowflake?

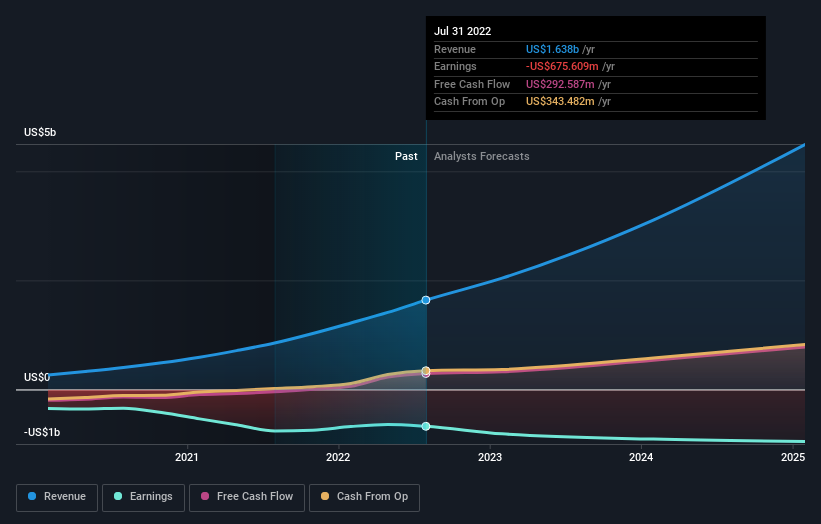

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. With profit expected to grow by 25% over the next couple of years, the future seems bright for Snowflake. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

Yahoo Autos

Yahoo Autos