It’s a Buyers’ Market for Now, but Car Shoppers Are Nervous

Election research conducted by Cox Automotive among 529 auto shoppers and 1,026 US auto dealers finds nearly three-quarters of shoppers expect the outcome of the November presidential election to affect the economy.

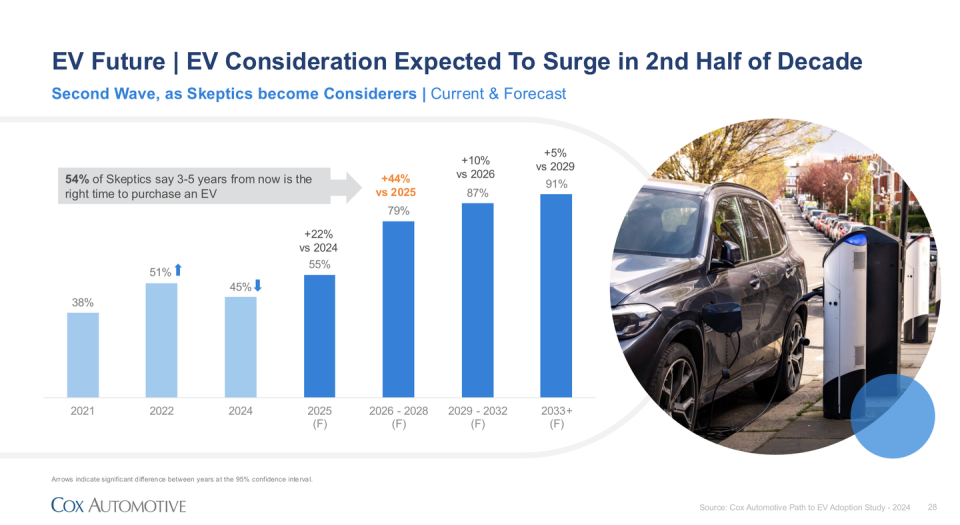

Cox projects EV interest will surge in the second half of the decade as EV consideration climbs by 44%, to 79%, by 2028. EV skeptics will become “considerers.”

The company expects second-quarter sales figures to find Toyota gaining market share and closing in on GM’s lead. (All-new 2024 Land Cruiser pictured above.)

Good news for new-vehicle buyers: With auto inventories returning to pre-pandemic levels, price incentives are going up at the same pace they were coming down during the COVID-19 mayhem, says Cox Automotive in its 2024 industry mid-year review.

This has done little to make auto dealers feel better, as consumers put off purchase decisions until they see what happens to a potentially stalling economy and persistently high interest rates.

Consumers also are uncertain how the November presidential election will affect all of this, says Jeremy Robb, Cox Automotive’s senior director, economic and industry insights.

Election research conducted by Cox among 529 auto shoppers and 1,026 US auto dealers finds nearly three-quarters of shoppers expect the outcome of the November presidential election to affect the economy.

Consumers do not expect their choice of powertrains—EV, internal-combustion or hybrid—to depend on a Joe Biden or a Donald J. Trump victory. A majority are opposed to federal government EV mandates, Cox’s research finds, a statistic political pundits may want to parse.

Conversely, Cox projects EV interest will surge in the second half of the decade as EV consideration climbs by 44%, to 79%, by 2028. EV skeptics will become “considerers,” Cox analysts say.

In pre-pandemic days, big pickup trucks typically got the biggest incentives, often in the five figures for mid- or high-trim levels.

But this year Hyundai, Kia, and Volkswagen (brands without big pickups) also have boosted incentives to push up sales, says Charlie Chesbrough, Cox Automotive’s senior economist. Jeep began an incentive push last year, he says.

“The big story,” Chesbrough says of industry sales trends analyzed in the mid-term review, is “we finished where we thought it was going to go.”

Overall, average transaction prices are down 1% over the first half of 2023, though they remain pretty high for the first half of 2024, at $48,389. There has been much hand-wringing among automotive analysts lately about what ATPs tell us.

If Ford, Chevy, GMC, and Ram sell, say, a lot of high-end pickup trucks and SUVs, this can skew to an unnaturally high overall ATP. But Cox is seeing equal growth for vehicles in the $30,000 to $40,000 range as in the $40,000 to $50,000 range and above $60,000, says Jonathan Smoke, chief economist.

Electric vehicle prices are up slightly, driven by Tesla’s 2.6% price hike in May, while EV days’ supply levels continue to run above industry average.

Average inventory is 104 days’ supply for EVs, not including all-EV automakers, compared with 73 days for ICE models. If you’re shopping EVs from traditional automakers, here’s where you should find the best bargains:

Volvo: 190 days’ supply

Chevrolet: 176

Audi: 174

Mercedes-Benz: 165

Ford: 133

BMW: 124

GMC: 109

Cox expects an 11% increase in EV sales for the second quarter over the first quarter, while EV market share will remain flat at roughly 8%.

On a year-over-year basis, hybrid-electric vehicle sales are up 152% and plug-in hybrids are up 59% for the second quarter.

Cox analysts project US auto sales for the first half of 2024 will be up 2.9% over the first half of 2023, when manufacturers release their sales numbers the first week in July.

General Motors again will likely be the sales “winner,” though market share will fall 0.5% to 16.2%. Toyota/Lexus gain 1.8% market share to 15.2% to strengthen its sales lead over Ford Motor Company, up 0.3% to 13.3%.

Cox is not changing its full-year 2024 forecast from what it projected at the beginning of the year. Cox Automotive expects 15.7 million new vehicles to be sold for the calendar year, 1.3 million (8.3%) of them EVs.

Post-pandemic, the automotive market is healthy, but all that uncertainty about the economy, the elections, and interest rates has automakers and dealers worried.

If manufacturers want to get back to the heyday of 16.5- to 17 million annual sales in the US, Chesbrough says, ATPs and interest rates will have to ease up far more.

Beyond the elections or the economy, are there other factors impacting your willingness to buy a car today? Please comment below.

Yahoo Autos

Yahoo Autos