Are Californians Falling out of Love with Tesla?

Vehicle registration data from the California New Car Dealers Association (CNCDA) shows that Tesla registrations have dropped 7.8% in the first quarter of the year, following a larger dip in the previous quarter.

Tesla still commands 55.4% of the BEV market in the state but now faces a much larger cast of competitors.

The first full quarter of Cybertruck deliveries did not appear to give a readily felt boost to Tesla's official numbers, with the EV maker having posted an 8.5% decline in deliveries in Q1 2024, year-over-year, hinting at a gradual start of truck production.

California has always been a hotbed of EV sales for obvious reasons, and this includes Tesla, which once called Fremont its headquarters. But the latest registration data in the early adopter state points to a trend that offers one possible cause for the reported turmoil at the Austin-based automaker.

Data from the California New Car Dealers Association (CNCDA) shows that Tesla registrations have dropped 7.8% in the first quarter of the year among all new car and light truck registrations, compared to the same period in 2023, following an even more significant 9.8% dip in the fourth quarter of 2023.

Still, that's 50,025 Tesla vehicles that were registered in the state in the first quarter of 2024.

This picture still roughly lines up with the disappointing first quarter for Tesla and may validate some fears of softening demand for EVs overall that was first noted in late fall 2022.

New vehicle registrations are one thing, vehicle production is another, and deliveries are yet another separate metric, and they may not all mirror each other in a given time period.

Starting in early 2023 Tesla responded to the waning demand with a series of price drops, sparking price wars in the process. And it continued to frequently correct pricing (in both directions) early in 2024, sometimes just days apart.

"The top three passenger cars sold were the Toyota Camry, the Honda Civic, and dropping from first place to third, the Tesla Model 3," the association notes.

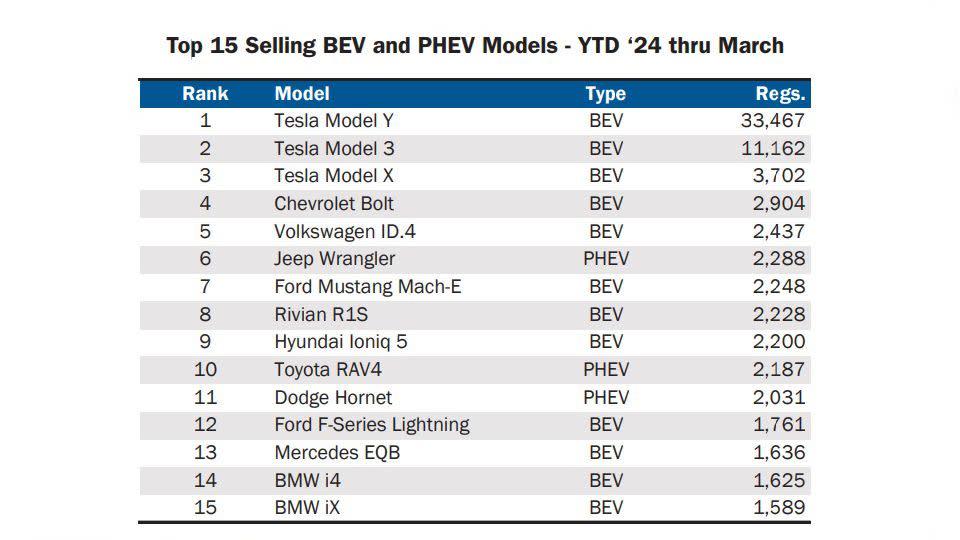

The good news for Tesla is that the Model Y is still the state's top-selling EV by a significant margin, having seen 33,467 registrations in the first quarter of the year, followed by the Model 3 at 11,162 and the Model X at 3702 units. Tesla models also came in first in several other segments, at times besting ICE vehicles.

Another bit of good news for Tesla is that it still held 11.6% of the California market in Q1 2024 among all types of new cars and light trucks.

Does the CNCDA have a theory regarding the slight downward trend in registrations for Tesla in the state?

"As Tesla's dominance wanes, traditional manufacturers are stepping up to the plate, offering new plug-in hybrid, hybrid, and battery electric vehicle models," the association noted. "This shift is evident in the sales of BEVs by traditional franchised dealerships, which have surged by 14% (while direct sellers saw a three-point drop) compared to last year's figures."

One other longer-term trend to note is that Tesla's market share in the state among EVs dropped from 61.8% this time last year to 55.4%, with the obvious culprit being the wider variety of EVs from other brands on sale. That's still a commanding position, and with more EVs on sale it was certainly expected to erode over time.

But the first quarter of 2024 perhaps should have still seen a bump for one simple reason, at least in theory: It was the first full quarter of Cybertruck deliveries in the US. Surely enough Tesla enthusiasts with deep pockets ordered them in California.

As Tesla's Cybertruck recall revealed a few weeks ago, the EV maker hasn't really been building the pyramid-shaped truck at full speed, at least not on par with older models like the Model S. The recent Cybertruck recall in April affected some 3,878 trucks, which hinted at just how many had been delivered nationwide since December 2023.

So we may yet see a rebound in the coming months as Cybertruck production gathers momentum.

Will Tesla continue to lose market share in California in the upcoming quarters, or will the promised new models and the Cybertruck give it a boost? Let us know what you think in the comments below.

Yahoo Autos

Yahoo Autos