Good News for Buyers, But Bad News for Borrowers

New vehicle supply in the US is just about up to pre-pandemic levels, although inventories remain low for Honda and Toyota, according to Cox Automotive.

Higher inventory levels overall pushing a return to substantial discounts off of the sticker price is offset by the high interest rates set by the Federal Reserve in its battle against post-pandemic inflation.

“I’m a believer that we should be cutting rates by three or four times,” said Cox Chief Economist Jonathan Smoke.

Save for Toyota, Honda, and Lexus, new vehicle supply in the US is just about up to pre-pandemic levels, and average transaction prices are down 5% from their pandemic peak, to $47,244 in February.

This spring could finally be a good time to shop for a new vehicle. But that’s if you can deal with the car loan’s interest rates, or pay cash.

“In 2024, we officially bid farewell to the seller’s market,” says a key takeaway from Cox Automotive’s first-quarter 2024 Industry Insights and Sales Forecast.

Cox analysts forecast the US will buy 15.7 million new vehicles in calendar year 2024, up only slightly from the 15.5 million sold in CY23. About half of this year’s sales increase will come from fleet, to an estimated 2.9 million, leaving 12.7 million (rounded off) for retail sales.

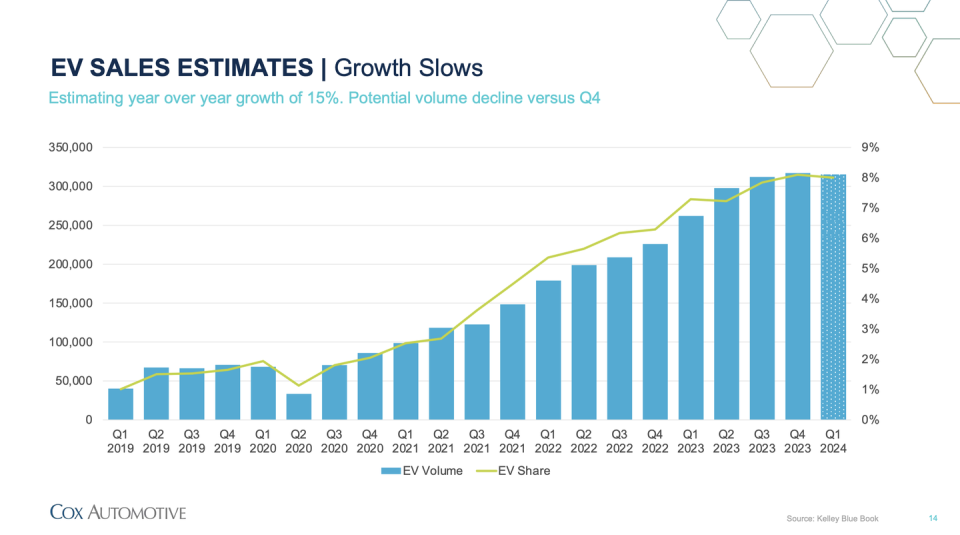

Cox’s Kelley Blue Book estimates EV sales will be up 15% for Q1 of ’24 versus Q1 of ’23, when numbers are finalized at the beginning of April. EV volume is expected to decline slightly from the fourth quarter of ‘23 but will remain above 300,000 for the quarter, equal to about 8% of the overall market.

New vehicle inventory was up 50% this outgoing quarter versus Q1 of 2023, with 940,000 more cars and trucks available year over year. Cox Automotive analysts expect little disruption in inventory, so far, after this week’s tragic Francis Scott Key bridge collapse in Baltimore, as auto and auto part shipments divert to other ports.

Higher inventory levels pushing a return to substantial discounts off of the sticker price is offset by the high interest rates set by the Federal Reserve in its battle against post-pandemic inflation.

Cox Chief Economist Jonathan Smoke said that interest rate offset should diminish if the Fed holds to its plan announced this month that it would cut the rate three times before the end of the year.

“I’m a believer that we should be cutting rates by three or four times,” Smoke said. “But now some (Fed) officials are backing down” from that plan, which would be the biggest risk for the automotive market this year.

If the Fed waits until the end of the year to decide whether to cut the rates, it will cause many potential buyers to hold off, despite lower prices from more discounting.

New car dealers rank interest rates the number one factor holding back business, according to Cox’s quarterly Dealer Sentiment Index, with 62% of dealers surveyed ticking it as a concern in the first quarter of this year, compared with 65% in Q4 ’23.

“Economy” remained second in this Cox survey, though down six points to 55%, and “market conditions” was third, down eight points to 40% (in the survey, dealers can tick off any or none of the 10 factors listed).

With inventories up and thus average transaction prices down, dealers “will have their fourth-most profitable year,” Smoke said, and the overall dealer mood is better than the data from Cox’s Sentiment Index.

Tesla vs. Other EVs

While EV sales overall rose 15% in the first quarter compared with Q1 of ’23, sales growth for all EVs except Teslas rose 33% year-over-year in the first quarter, according to Cox Industry Insights Director Stephanie Valdez Streaty.

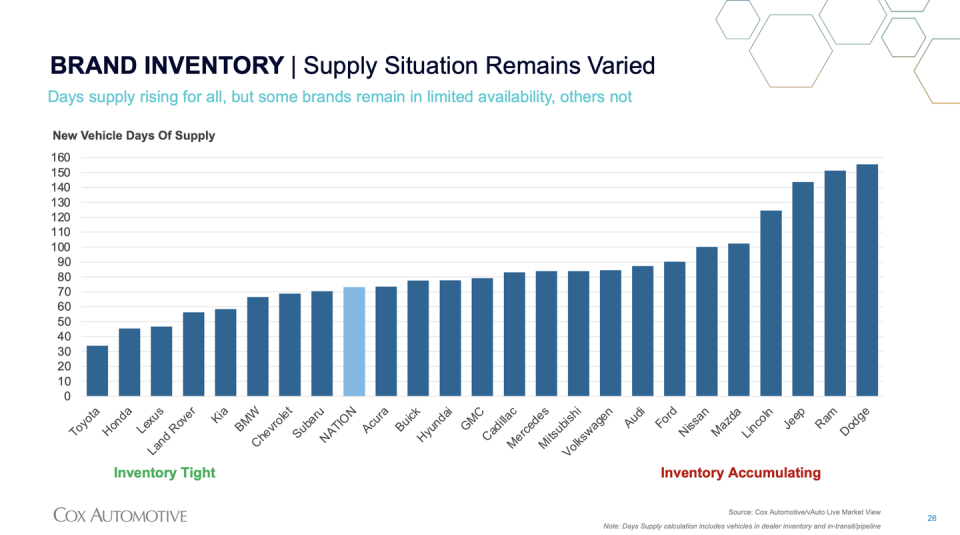

There was a 114-day supply of all EVs including Teslas, in February, compared with 74 days’ supply for all vehicles.

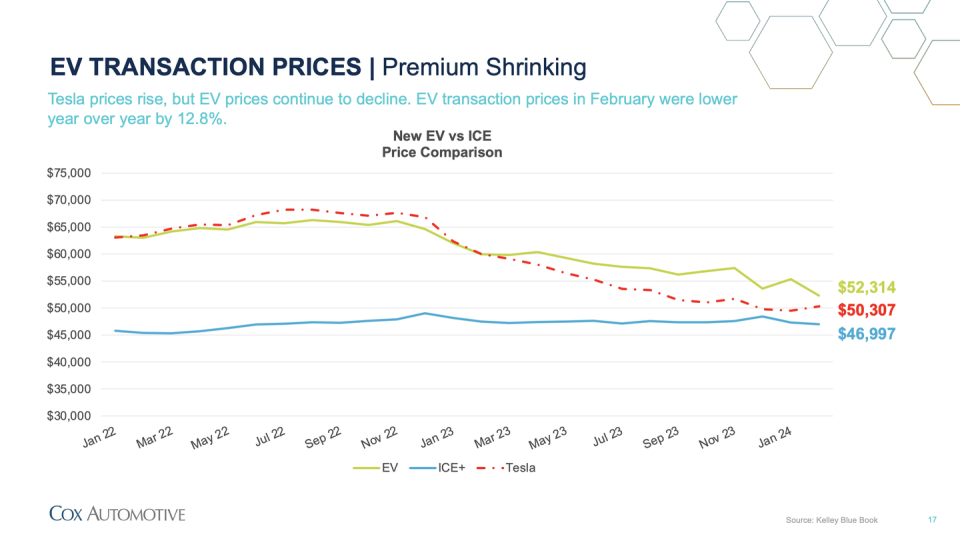

February ATP for all EVs was $52,314, which was $5317 higher than the ATP for internal-combustion, hybrid, and plug-in hybrid vehicles. But Tesla’s ATP for February was $50,307, or $3310 more than the $46,997 ATP for ICE, HEV and PHEV models.

Hybrids Rising

ICE models took 83.2% of the market in calendar year 2023, down 4.2 points from CY22. While battery-electrics’ share rose from 5.8% to 7.6%, HEVs were up from 5.5% to 7.4% in CY23, and PHEVs were up from 1.3% to 1.8%. You can bet that HEVs and PHEVs will lead increases in 2024.

Jeeps Dominate PHEVs

No surprise that Tesla’s Models 3 and Y accounted for 52% share of the EV market in 2023. It might be more of a surprise that the Jeep Wrangler and Grand Cherokee plug-in hybrids, along with the Toyota RAV4, accounted for 45% of PHEVs sold last year.

Honda CR-V and Accord, and Toyota RAV4 hybrids took 38% share of the HEV segment.

What We’re Buying

The biggest single auto market segment, compact crossover SUVs, are on the upswing, breaching 18% of the market in the first quarter of this year. Midsize SUVs are second, though inching down to just over 16%. Number-three full-size pickups are falling more quickly, from nearly 14% for 2023 to about 12% in the first quarter of ’24.

Subcompact SUVs, compact cars, and luxury compact SUVs are all on the upswing while midsize cars and luxury midsize SUVs are going down. These eight top segments make up 80% of the market.

Cox analysts say small and midsize pickup trucks are taking sales from the big trucks, and now are the ninth-largest segment in the US.

What We Can Buy

About those encouraging inventory levels: Eight brands have supplies below the 73-day median, though Subaru and Chevrolet are close, at roughly 70 days each, and BMW is just below.

Kia and Land Rover are in the 55-60 day range, and Lexus and Honda, in the mid-40s, and Toyota, under 40, are in the you’d-be-lucky-to-pay-sticker range.

Of course, this will vary by model, and that goes for the most overstocked brands, with Dodge’s mid-150s-day supply the very highest. Ram and Jeep are just behind, and Nissan, Mazda, and Lincoln are at 100 days or more.

If you’re in the market for a new car, what’s the mood like in showrooms? Please comment below.

Yahoo Autos

Yahoo Autos